By Daniel Karns and Alberto Coria

A sharp increase in Covid cases and zero-Covid policies implemented across China resulted in massive shutdowns of city, ports, and business operations in Shanghai and surrounding cities. These shutdowns have impacted the movement of goods out of ports into mainland China where those goods are processed into consumer products. The implications of China zero-Covid policy supply chain disruption are immense. With no movement of goods, prices increase, labor shortages occur, backlogs at ports increase, and manufacturing operations stall as inventories deplete.

China Zero-Covid Policy Supply Chain Disruption on a Domestic Scale

Road freight constitutes one of the key infrastructures and transportation services in China. Approximately 76% of all cargo and goods are moved from ports into mainland China via truckers. Despite being a key industry, trucking in China is only operating at about 20% capacity due to zero-Covid policies and city shutdowns in Shanghai, further compounding the fragmentation and inefficiencies already within the trucking industry. About 90% of truckers operate independently, meaning the driver owns their own truck and operates on contracts from companies needing goods transported to and from their facilities.

Several economic factors result from such heavy market fragmentation. First, this creates an information/communication problem between truckers, suppliers, and manufacturers. Open-source intelligence indicates that truckers have no way of knowing where the demand is since there is no sole coordinating agent. This leads to inefficiencies and long lead times when sending and receiving goods. Different regions of China have different rules and regulations, further complicating coordination.

For long-distance freight truckers, transporting goods has become considerably more arduous as Covid-related protocols now include negative Covid tests that are only valid for 24 hours and special permissions and licenses, and limited routes to travel. Truckers are also not allowed to travel to ports and cities experiencing Covid-19 outbreaks, which would include the busiest ports in China. Additionally, drivers now intentionally avoid high-contamination areas since contracting the virus would result in two or more weeks of no income. Second, wages for truckers decrease since drivers possess no bargaining power due to their independent operating status. Additionally, drivers will consistently underbid each other to win contracts to secure consistent work, further decreasing wages.

The national average salary for a trucker in China lies just under 20,000 USD. Although it is above the national average of 15,000 USD, independent truckers have to incur all the costs when transporting goods. Toll roads in China rank as the most expensive in the world and pose additional costs on the transportation of goods. This further lowers the profit margin for drivers and impedes the delivery of wares. Drivers also must cover their own fees and costs incurred from meeting all regulations and being compliant, costing up to half of what the trucker would make.

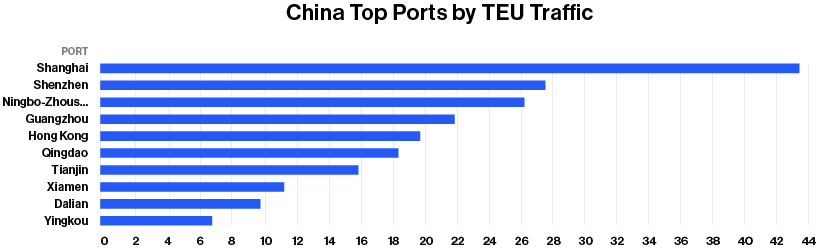

In terms of sea freight, the impact of China’s zero-Covid policy on the supply chain is not much better. Globally, about 20% of the world’s roughly 9,000 active containers are anchored outside congested ports. Seven of the ten largest ports in the world are in China, indicating major consolidation risk in the event of shutdowns. Vessels waiting outside of Chinese ports account for about 27.7% of all vessels waiting outside ports globally. The number of vessels outside Chinese ports increased by 195% since February 2022, almost doubling its congestion in the span of two months. As of February 2022, Chinese ports had 260 vessels waiting outside the ports, jumping up to 506 vessels in April 2022.

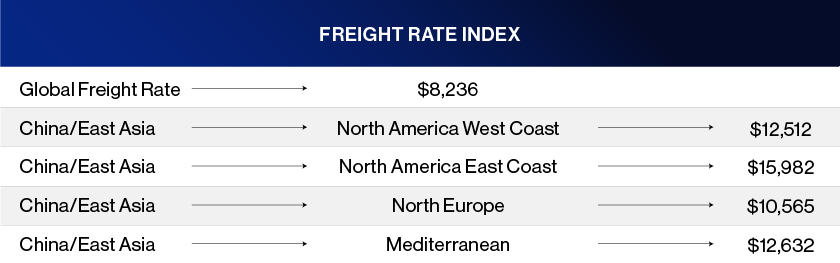

Backlogs and port closures also spurred a shortage of shipping containers since imports were no longer coming in with the empty containers. As a result, Chinese exporters are having to pay two to three times more than pre-pandemic costs to ship anything. The Freight Rate Index measures market rates for freight for different shipping lanes. Displayed by the visual below, the freight rates out of China are much higher than the global average and the highest among other shipping lanes.

Rail freight is also affected by the shipping shortage as well as restrictions and limited alternatives to move goods. There are two main routes for rail freight out of China: one goes through northern China into Siberia to get to Europe, and the other goes through Kazakhstan to get to Europe. However, trade restrictions and a myriad number of sanctions placed on Russia render both these routes obsolete as shipments coming through Russia to neighboring countries face severe hindrances and restrictions because of the ongoing war in Ukraine. If rail shipments move out of China, there are several dependencies that can prevent shipments from returning. This would in turn result in a loss of shipping materials/containers and raw materials required for the manufacturing of end-user products. Like sea freight, movement of goods by rail closely depends on the availability of shipping containers. Currently, the backlog on ports due to closures and backlogs have left many rail freight companies without any way of shipping or moving goods, highlighting a vulnerability within rail freight.

Most airports in key ports and towns reached capacity or have suspended operations of air freight due to Covid restrictions and capacity limitations. Airports are also pausing movement of goods through the air and keeping cargo from being unloaded. Freight is being diverted from Shanghai into neighboring ports and airports but capacity in the surrounding cities is quickly filling up.

- Guangzhou and Xiamen airports have already suspended trucking services to Shanghai, Ningbo, and Hangzhou airports.

- Nanjing airport suspended import operations while Zhengzhou currently experiences seven days of backlog and takes three to four days to turn around processing.

- Shanghai airport has suspended all truck services, air cargo services, and most flights as well as requiring a government permit to travel to other locations.

The Impact of China’s Zero-Covid Policy on International Supply Chains: An Overview

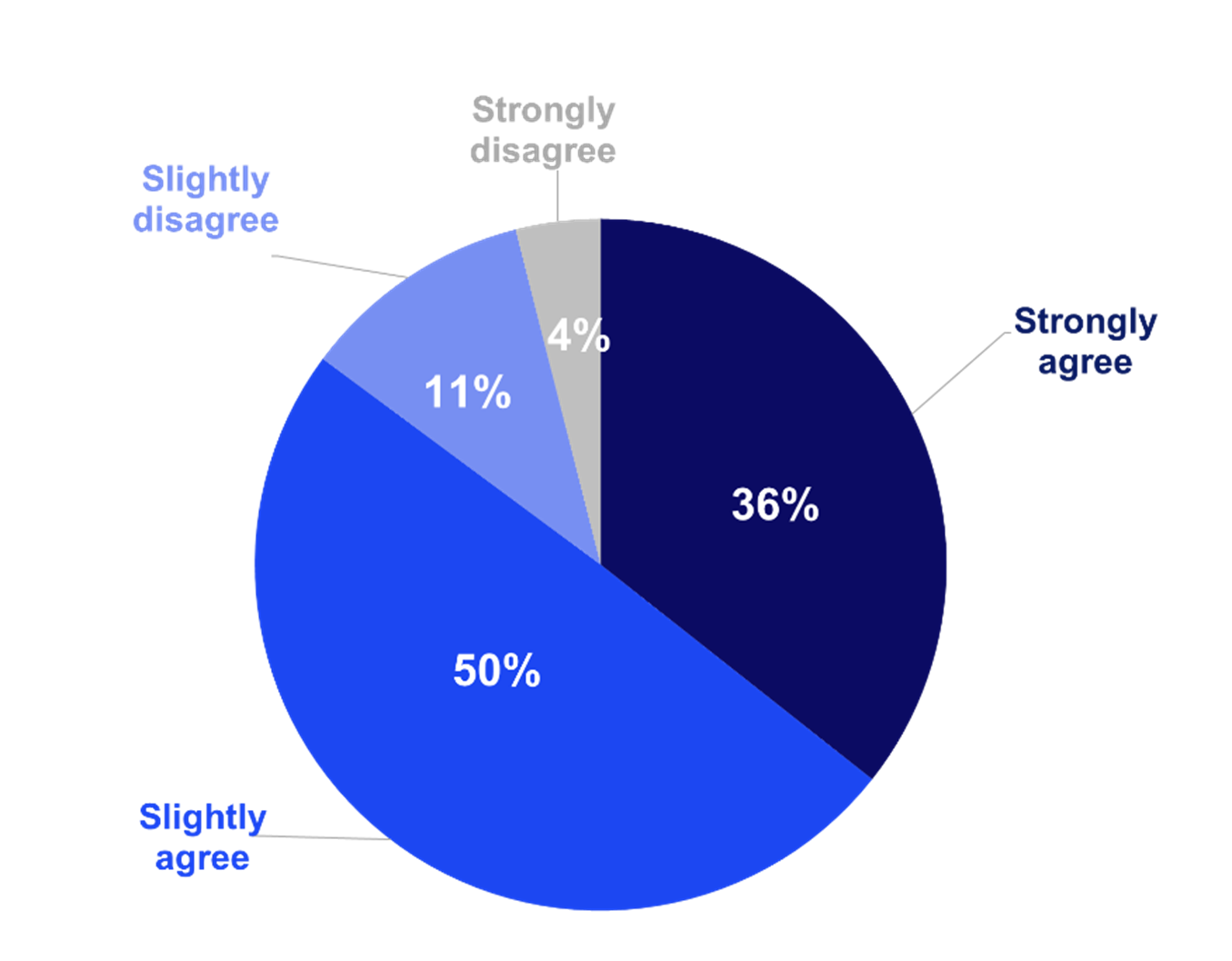

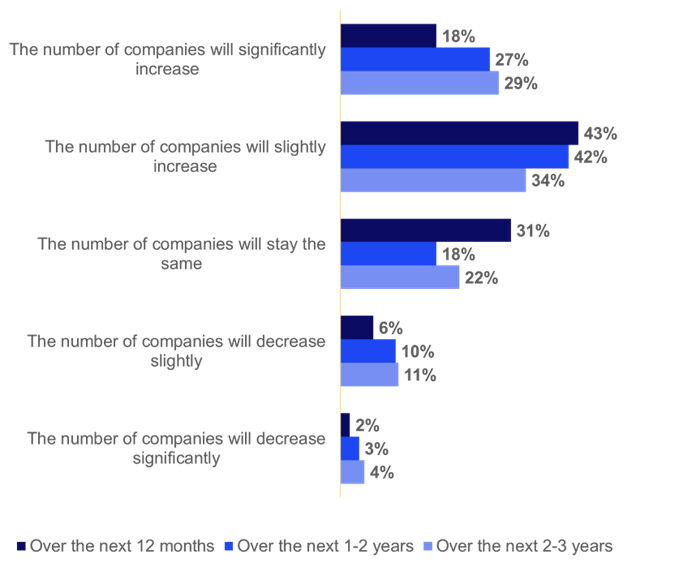

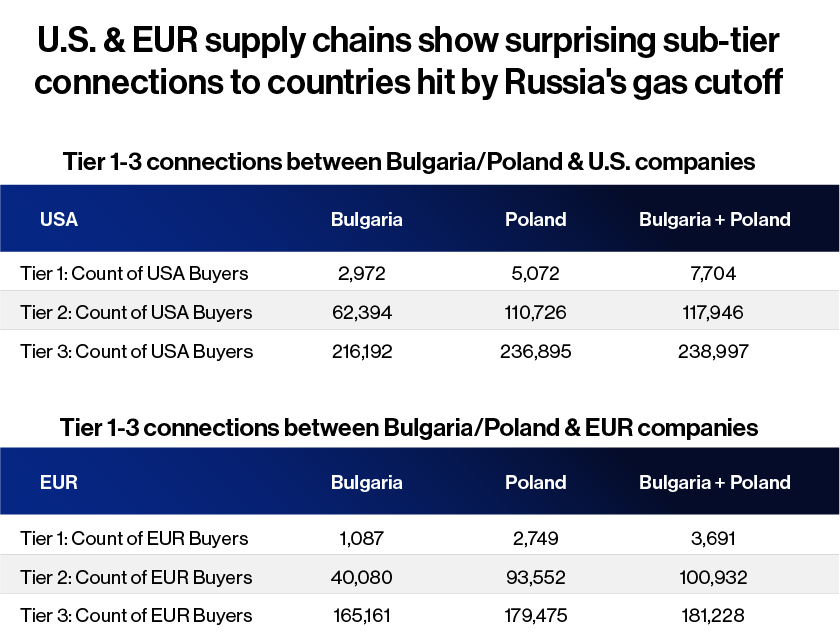

Much of the impact of China’s zero-Covid policy on supply chains will likely come from China’s 2022 Shanghai lockdown, and will have long-lasting effects on the world’s supply chains. The lockdown will likely exacerbate inflation issues by reducing the supply of consumer goods and raising the rates on cargo shipments from China to western ports. The lockdown will also overwhelm ports in the United States and Europe with a surge of shipments once it is lifted. Additionally, the ongoing lockdown in Shanghai, as well as the movement restriction orders elsewhere in China, have reinvigorated the desires of many western procurement teams to better understand and diversify their supply chains. These effects are likely to continue being absorbed by the global economy up to through the first half of 2023.

Shanghai’s port is expecting a surge in shipments once it reopens, as there are currently over 500 ships stranded at its gate. In addition to the shipping disruptions the Shanghai lockdown is creating, European and American companies are reporting that half of their logistics, warehousing, and supply-chain operations are being adversely impacted by the lockdowns occurring in China. Furthermore, nearby manufacturing hubs in Vietnam and Cambodia are suffering from a shortage of Chinese components for their electronic and textile manufacturing industries, and pharmaceutical companies in India such as Abbott India Limited and Mankind Pharma Limited are facing limited supplies.

An important reference to analyze is last year’s lockdown at the Yantian port of Shenzhen, and how it caused logistical disruptions for the United States and Europe. In May of 2021, over 100,000 shipments were not allowed to enter or exit the Yantian port, which resulted in containers accumulating in factories and warehouses. Several weeks after the port opened in Shenzhen, ports in the United States and Europe experienced severe congestion and backlogs, which have only been cleared since the end of Q1 2022. The Shanghai lockdown is likely to have an even stronger effect on ports in the United States and Europe, as Shanghai is the biggest container port in the world and this year’s lockdown is much more heavily enforced by Chinese port authorities and the central government. Furthermore, Shanghai’s lockdown is affecting all forms of transportation and manufacturing in the city, causing the effects to be more widespread than the Yantian case which was primarily isolated to the port and production hubs.

When the Shanghai lockdown is lifted and resumes normal port operations, then ports in the United States and Europe will likely see a drastic surge in imports, potentially overwhelming their intake systems and procedures. Major American ports such as Long Beach and Los Angeles are already at full capacity due to lack of equipment, labor negotiations, and existing backlog from Covid-related supply chain issues.

One of the most prominent long-term effects that will manifest as a result of the Shanghai lockdown will be further price inflation on goods that are heavily reliant on Chinese sourcing and shipping, specifically those that rely on commodities such as copper and aluminum to be manufactured. As manufacturers in industries such as electronics or automobiles are deferring purchases of raw materials due to Shanghai’s lockdown, commodities have temporarily become cheaper, but will become more expensive as a surge in orders returns at the onset of Shanghai’s economy opening.

The lockdown of Shanghai has also caused delays estimated to be at least several months for shipments going to semiconductor manufacturers and automakers in the US and Europe. The full impact is yet to be known, as 45 cities are under lockdown measures of varying severity. It is estimated that 1.3 trillion USD worth of Chinese inputs are used in the electronics and automotive sectors by the rest of the world, with Japan, South Korea, Vietnam, India, and Germany being the most exposed countries.

While the Shanghai lockdown is having a drastic effect on shipping logistics worldwide, China still has seven of the world’s ten biggest container ports (Shanghai, Ningbo-Zhoushan, Shenzhen, Guangzhou, Qingdao, Hong Kong and Tianjin). While slow to react, the other major Chinese ports listed are beginning to coordinate to import and export containers that have been diverted from Shanghai.

While many of the effects of China’s “zero-Covid” strategy are already being absorbed by the global economy, they are likely to continue for the remainder of 2022 and into the second quarter of 2023. It will be crucial to continue monitoring China’s domestic restrictions on the movement of goods and its primary port activities or traffic.

Download our white paper to learn more about this topic: Second Order Disruptions China COVID Lockdown Analysis – Interos