By Geraint John

As the annual Earth Day takes place again on April 22nd, the world faces an all-too-familiar message: we are not doing enough to confront the impact of climate change and human-inflicted damage to our fragile environment.

Global supply chains, as the engine room of trade and economic growth, are a major source of carbon dioxide emissions, deforestation, water and natural resource wastage, and pollution – which explains why national governments are busy introducing laws to regulate companies’ activities more tightly.

In the European Union, for instance, legislation currently in progress includes:

- A carbon border tax on greenhouse gas emissions associated with imported products to begin operating from October 2023.

- A ban on imported products linked to deforestation from 2024.

- A Corporate Sustainability Reporting Directive that will require around 50,000 companies to disclose environmental impact data and set improvement targets.

In the United States, current proposals include:

- New Securities and Exchange Commission (SEC) reporting rules. These include disclosure requirements for CO2 emissions in listed companies’ supply chains (so-called Scope 3 emissions).

- Tough new Environmental Protection Agency (EPA) limits on tailpipe emissions from fossil-fuel-powered cars and other vehicles.

This surge in regulatory activity will, over time, certainly force many firms to improve their environmental practices. But those leading their procurement and supply chain organizations need to go beyond compliance with these laws if change is to be effective on the scale required.

Coming to Terms with the Impact of Supply Chains on the Environment Is No Small Feat

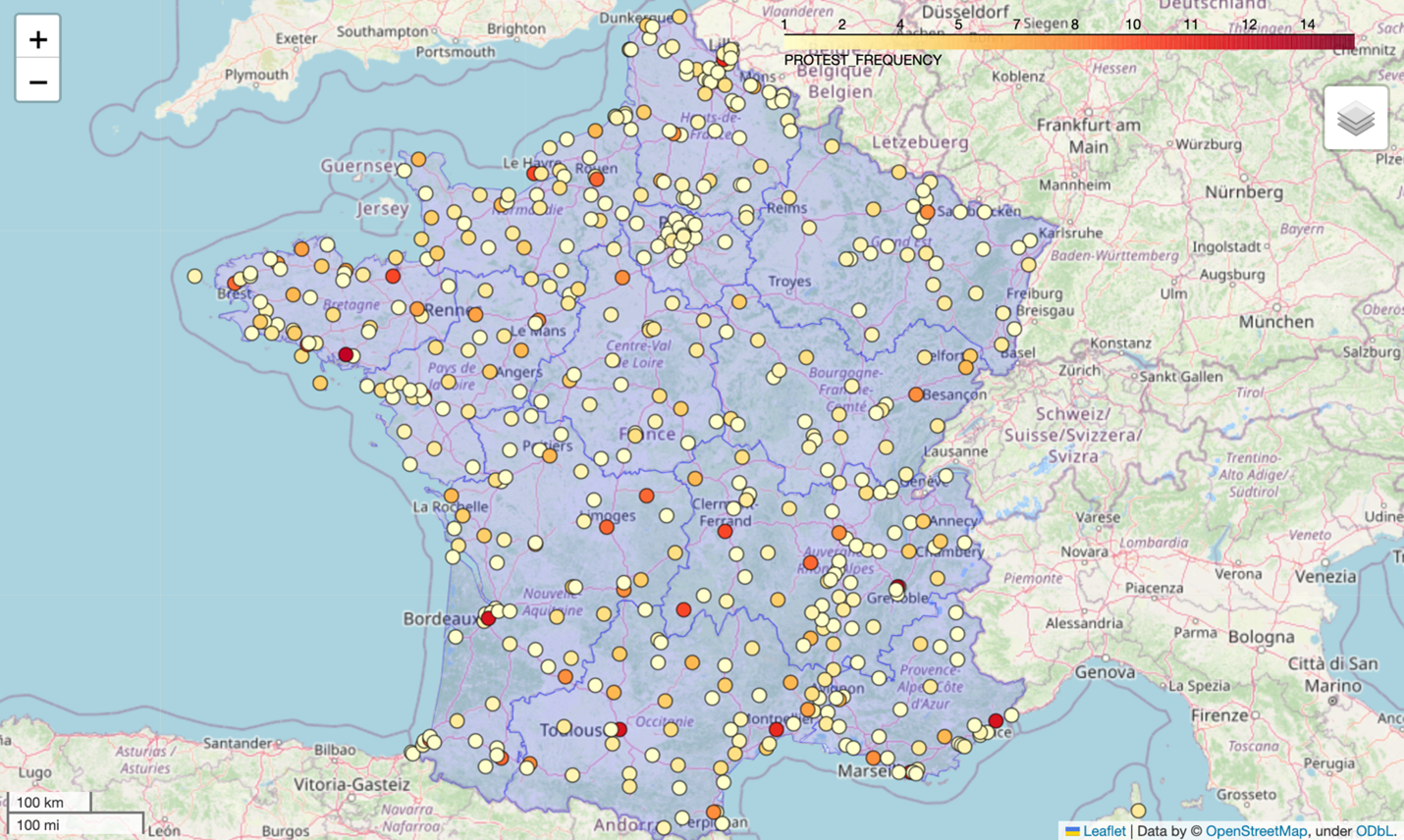

To mark Earth Day 2023, Interos conducted an analysis of its ESG risk-scoring data, ranking the best and worst countries based on their performance against a dozen environmental attributes — which will be published soon (check back here for a link).

The key finding from this analysis is that even the “best performing” countries – and the companies headquartered there – have their work cut out to meet net-zero emissions, limit temperature rises to 1.5°C, and hit other key environmental targets.

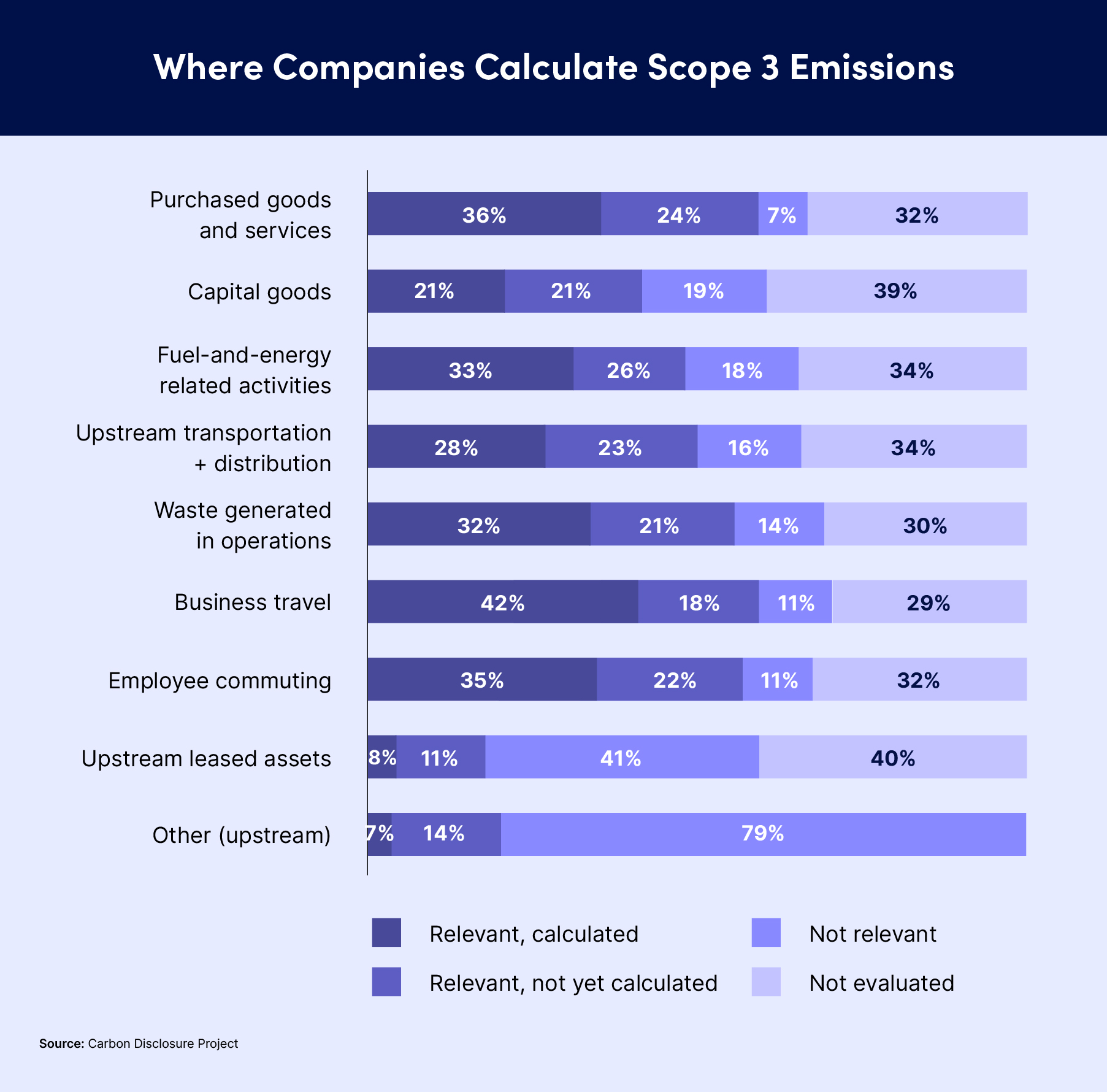

Research by the Carbon Disclosure Project (CDP) reveals that supply chains are not yet contributing at anything like the scale required to effect meaningful change. Data it collected from thousands of firms in 2022 shows that:

- Only 41% reported any Scope 3 (supply chain) emissions, compared with 72% for Scope 1 or 2 (internal operations). This is despite the fact that Scope 3 emissions are typically more than 11 times greater.

- Just 36% of reporting firms were able to calculate Scope 3 emissions for purchased goods and services.

- Relatively few companies currently provide detailed reporting on water consumption or deforestation in their own operations, let alone in their supply chains.

The CDP welcomes the regulations mentioned earlier, which will force many more companies to measure and report their broader supply chain environmental impact. But it argues that “the necessary cascade of action down the supply chain is just not happening”.

Compelling direct (tier-1) suppliers to provide data and make improvements isn’t sufficient. Active engagement, incentivization, and collaboration with a targeted group of direct and indirect (tier-2+) suppliers are necessary to drive change.

Just 39% of companies engage their suppliers on climate-related issues, says the CDP, while 23% do the same for water. The figure is higher for deforestation (69%), but this is tempered by the fact that relatively few firms disclose data on this issue.

ESG and Procurement: From Compliance to Engagement and Continuous Monitoring

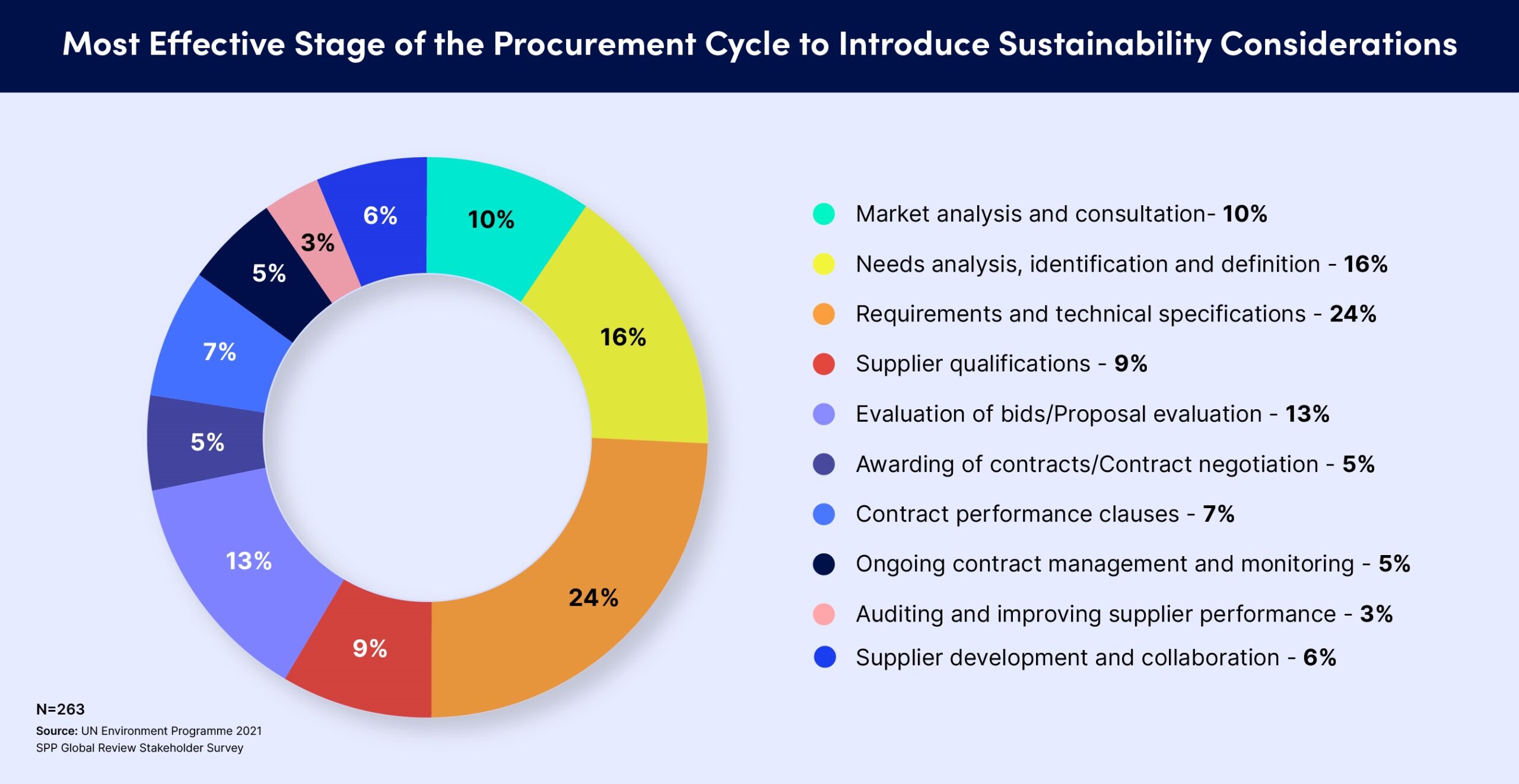

A separate report on sustainable procurement by the United Nations Environment Programme also notes the growing body of legislation, but cautions buyers against a “superficial compliance oriented approach”.

It urges them to look beyond the needs analysis, supplier selection, and onboarding stages of the procurement cycle, where most activity takes place today (see chart), and put more emphasis on post-contract supplier management.

The need for continuous monitoring and intervention along the supply chain, rather than just one-time certification, is as important in environmental performance as it is for other types of supplier risk, such as labor standards and cybersecurity.

How Procurement Leaders Can Make ESG Progress

Chief procurement officers (CPOs) face plenty of complex challenges as they work to improve environmental sustainability in their organizations. Collecting relevant data and measuring results is certainly not the smallest one.

But, aside from it being “the right thing to do”, there are real business benefits to be gained. These include creating lower-risk, more resilient supply chains. Organizations will also enjoy commercial advantages over rivals in terms of innovation, customer perception, and sales. They also have greater attractiveness to stakeholders such as investors and employees.

A new study by Bain and Ecovadis also found that companies “at the forefront of sustainable procurement,” which focus on their suppliers’ environmental practices, are more profitable – by an average of three percentage points over other firms.

Practical steps CPOs can take to make progress on this journey include:

- Raising internal awareness of supply chain-based climate, water, deforestation, and other environmental issues. This includes both within their own teams and others they work with.

- Designing incentives to ensure that buyers and category managers pay sufficient attention to sustainability considerations at different stages of the procurement cycle.

- Writing climate, water, and other requirements into supplier contracts and including sustainability KPIs in scorecards and regular performance reviews.

- Harnessing technology to identify the highest-risk supply chain dependencies. Also, collecting environmental data to conduct analysis and support decisions.

- Engaging suppliers not only to disclose and share information about CO2 emissions, water usage, and other activities, but also to encourage and incentivize them to take action to improve their environmental footprint.

Actions such as these mark a big change from the “traditional” procurement focus of lowering costs and ensuring supply. But CPOs in leading companies are increasingly staking their reputations and careers on it.

For the sake of our planet, the efforts of these leaders and others need to become a source of celebration on future Earth Days.