By Geraint John

As if a pandemic, war, labor strikes, and rampant inflation weren’t enough, supply chain leaders now have another disruptive force to contend with – mass-scale drought.

From the U.S. and South America to Western Europe and China, record-breaking heatwaves and exceptionally low rainfall are disrupting not only agriculture, but also power generation, manufacturing, and logistics, necessitating drought risk management on a massive scale.

For many companies, severe water scarcity will be the first tangible impact of the relationship between climate change and supply chains. It should act as a wake-up call to take this category of supply chain risk more seriously and model it more systematically in footprint investment and supplier selection decisions.

Manufacturers are suffering from the heat

Farmers and agricultural producers are used to drought risk and their crops being at the mercy of extreme weather, from major storms and floods to wildfires and drought. But for manufacturers, recent events are more unusual, and make operational resilience more important than ever before.

In Germany, chemicals firms and car makers are among those that have been affected by low river levels in the Rhine, making it impossible for the biggest barges to transport their products to ports and onwards to customers.

Almost half of Europe is currently experiencing drought, according to a new European Commission report – the worst situation in 500 years.

In China, which is battling its most severe heatwave on record, hydroelectric power plants have been taken offline this month by low water levels in the Yangtze River. This has forced many manufacturing firms in Sichuan, Zhejiang, Jiangsu, and Anhui provinces to suspend operations.

Those impacted by rationing measures include Toyota, Volkswagen, Apple supplier Foxconn, and CATL – China’s biggest lithium-ion battery maker – according to news reports.

Analysis of Interos’ global relationship mapping platform data shows that:

- There are over 560,000 relationships between suppliers in the four affected Chinese provinces and buyers outside of China.

- More than 185,000 distinct foreign entities buy from Chinese suppliers in these regions.

- The main industries represented by these trading relationships include machinery, electronic equipment and components, chemicals, and textiles.

- In Germany, BASF – the world’s largest chemicals company and a major user of the Rhine for transportation – supplies almost 1,400 customers directly (tier 1) and over 86,000 indirectly (tier 2) in sectors such as chemicals, pharmaceuticals, food products, and apparel.

Drought risk management is an increasingly dire concern

While the scale and intensity of this summer’s droughts are the worst for many years, they shouldn’t come as a big surprise to companies that have been following discussions about climate change and supply chain risks:

- Research by the United Nations shows that the number of droughts across the world has risen by 29% since 2000.

- The Intergovernmental Panel on Climate Change has been warning that drought and other extreme weather events are becoming more common since its formation in 1988.

- Extreme weather was ranked as the number one most likely risk in the World Economic Forum’s annual global risks perception survey for five years in a row from 2017.

As climate change increasingly impacts supply chains, the implications are dire. Interos’ proprietary risk i-Score shows that in terms of “natural disasters” (an attribute of operational risk that includes meteorological and climatological events):

- China is in the top 10 highest-risk countries and territories, with a ranking of 240 out of 249 and a score of 12.1/100.

- The U.S. is in the top 20 highest-risk countries and territories, with a ranking of 234 out of 249 and a score of 14/100.

- Germany is, by comparison, considered much lower risk for natural disasters, with a score of 82.4/100, although it still only ranks mid-table at number 134.

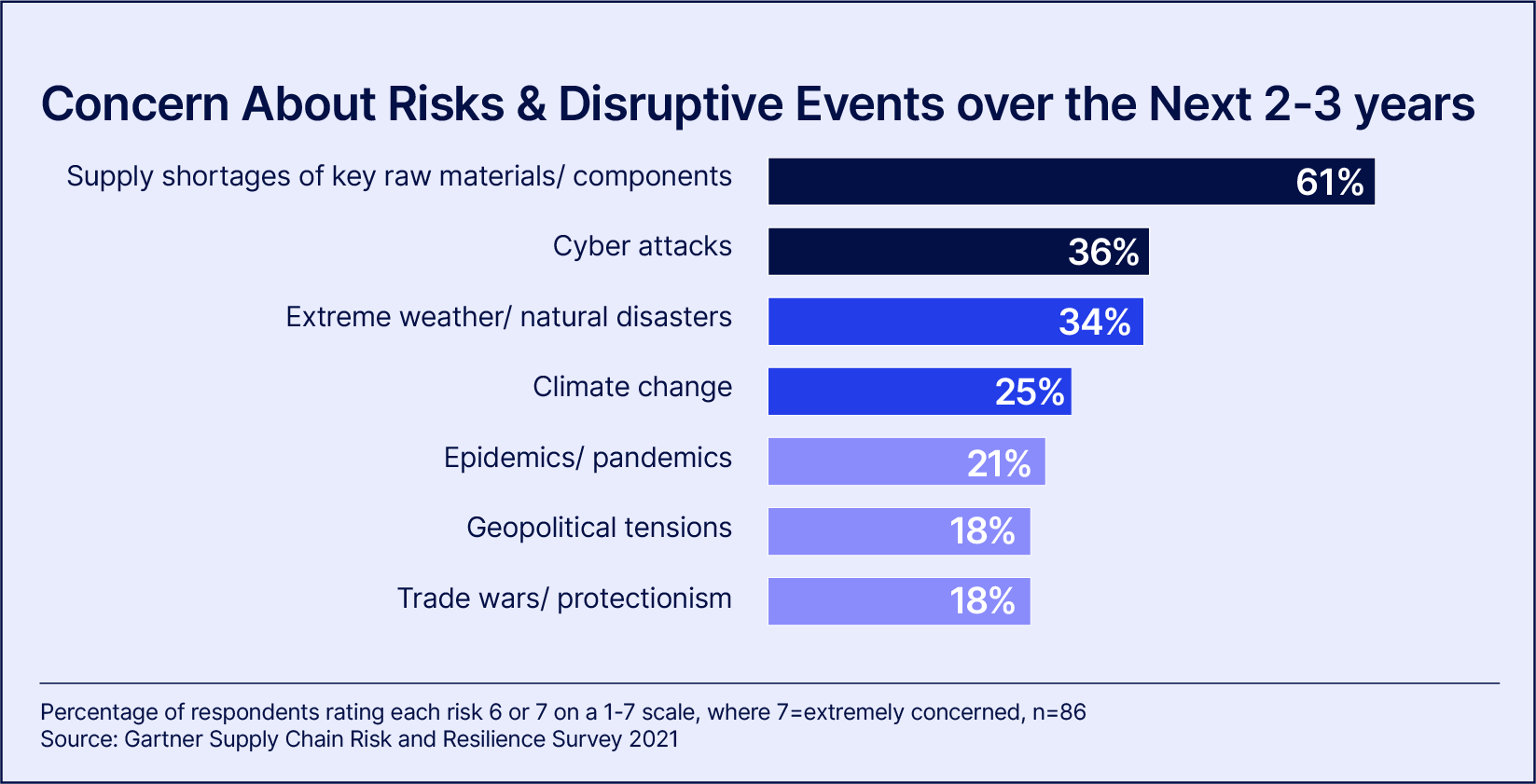

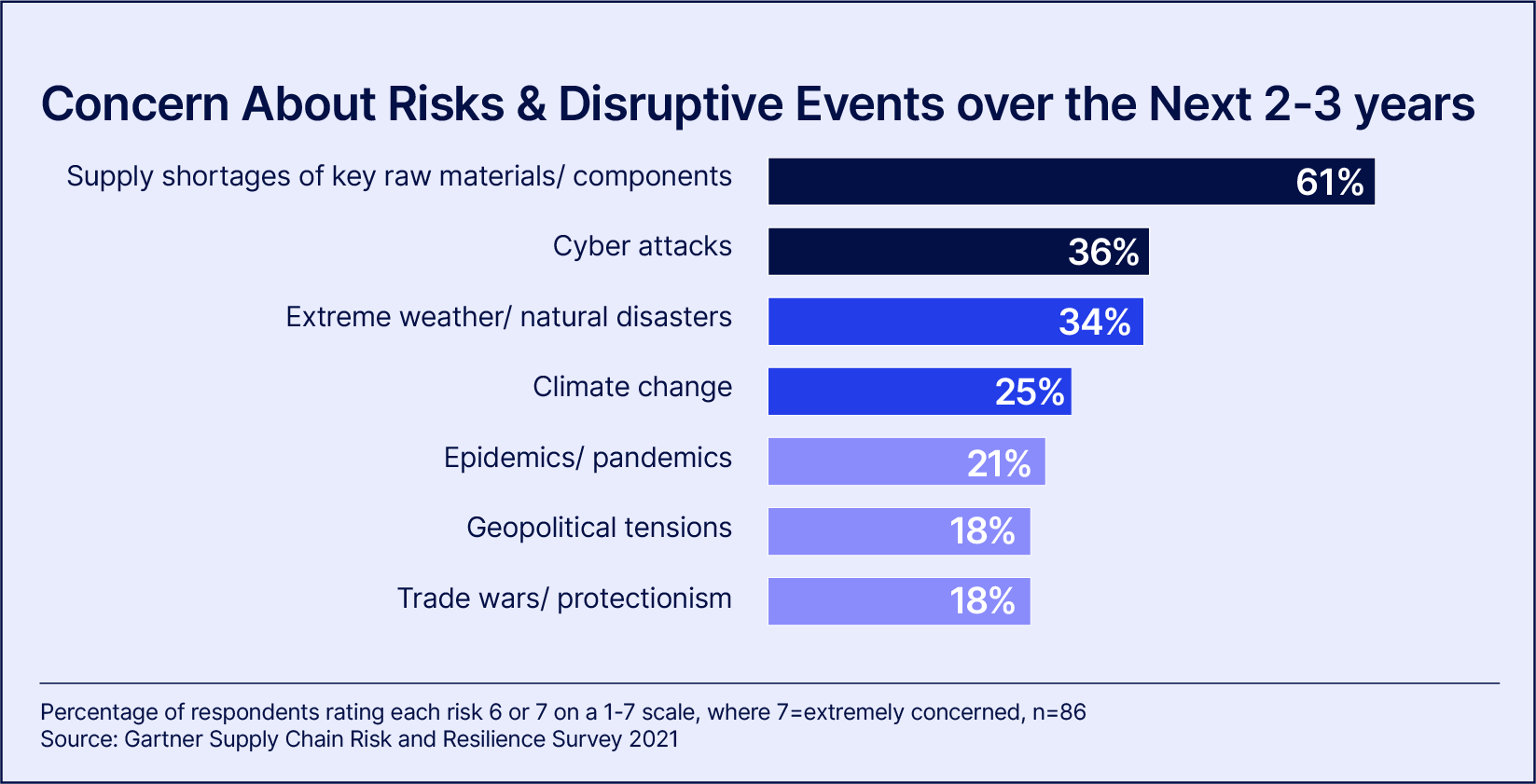

A Gartner survey of procurement leaders in the DACH region last year found that extreme weather and natural disasters were rated as the third highest risk for the next 2-3 years after cyber attacks and supply shortages.

A quarter of the sample also rated climate change as very or extremely concerning, putting it ahead of pandemics, geopolitical tensions, and trade disputes (see chart).

Past events are not always a guide to climate change and supply chain risks

Sentiment in the U.S. and other parts of the world will no doubt vary somewhat, but these findings demonstrate that drought risk management and other extreme weather concerns are recognized as more significant supply chain risks than they would have been a few years ago.

Another recently published Gartner survey found that just 11% of 320 supply chain leaders “do not consider climate change as a future risk”.

- Just over a quarter (27%) said they had conducted a climate change risk assessment and identified their most critical supply chain risks.

- Just under a fifth (18%) had conducted risk assessments and scenario planning around climate change.

- Almost half (44%) said they had “a general sense of potential future climate risks based on events from the last three years”.

This last finding is a little concerning, given the extremely hot and dry conditions afflicting so many countries in recent months.

The lesson must surely be that the risk of drought risk management – along with other disruptive weather considerations – is no longer as predictable and as confined to certain areas of the world as it used to be. The future is going to look different than the past, so relying solely on historical patterns is dangerous.

Instead, companies are going to need to model climate change-related supply chain risks much more diligently than they have previously when deciding where to build new manufacturing and distribution facilities, and when making critical supplier selection decisions.

To learn about how the Interos platform can help to protect your supply chain from drought risks and other potential impacts of climate change, visit interos.ai.