Pressure on U.S., European and other companies to cut ties with Russia has been building over the past month since Vladimir Putin’s invasion of Ukraine.

Most of the public debate and media attention has been on companies that have closed their shops, offices, and factories and stopped selling to Russian customers. This growing list includes the likes of McDonald’s, Coca-Cola, Starbucks, Apple, H&M, IKEA, and Ford.

This is both a sales revenue and inbound supply chain story. It is a sales revenue issue because these companies will be foregoing income from Russian customers due to their decision to stop operating in the country. It is an inbound supply chain issue because, in many cases, they will either have to cease shipments of ingredients, raw materials, parts, and finished goods imported into Russia and/or cancel planned orders from suppliers manufacturing there.

However, the mass exodus from Russia is also an outbound supply chain story – and this arguably has more severe implications for Western companies.

Russia’s supply chain a major source of raw materials

Russia remains a relatively small economy by international standards. For example, it is slightly bigger than Australia in GDP despite having more than five times the population. The sales losses from shutting down operations there are something that most foreign firms will be able to absorb.

But Russia is also a significant exporter of essential commodities such as energy, metals, and crops that aerospace, automotive, industrial, food, and other manufacturing companies operating outside the country depend.

Russia is:

- The world’s second-biggest exporter of crude oil and the largest source of natural gas

- A significant producer of nickel, platinum, titanium, steel, aluminum, palladium, copper, and uranium

- The world’s top wheat exporter, selling over 38 million tons globally

Additionally, Ukraine is a major exporter of corn, barley, and rye and produces more than half of the world’s supply of semiconductor-grade neon.

While most of these commodities are currently not the subject of Western government sanctions, supply availability and shipping delays are growing concerns, and prices have skyrocketed as markets exhibit significant volatility.

Given this situation, and amid uncertainty about how long the war will continue and how far-reaching its impact could be, many organizations have to rethink their sourcing strategies concerning Russia and Ukraine.

A case in point: on March 7, Boeing announced it was suspending its purchases of titanium from Russia, which accounts for around one-third of its total supply needs.

Getting visibility of Russian suppliers

Many U.S., European and Asian companies don’t want to be seen as supporting the Russian economy, let alone helping to fund its war machine. They are, consequently, reconfiguring their supply chains and sourcing strategies for both operational and reputational reasons.

To avoid doing business with Russia from outside the country, companies first need to understand who directly buys vital materials, components, and products. They also need to get visibility of other Russian-based entities they are indirectly connected to further upstream in their extended supply chains.

This is far easier said than done.

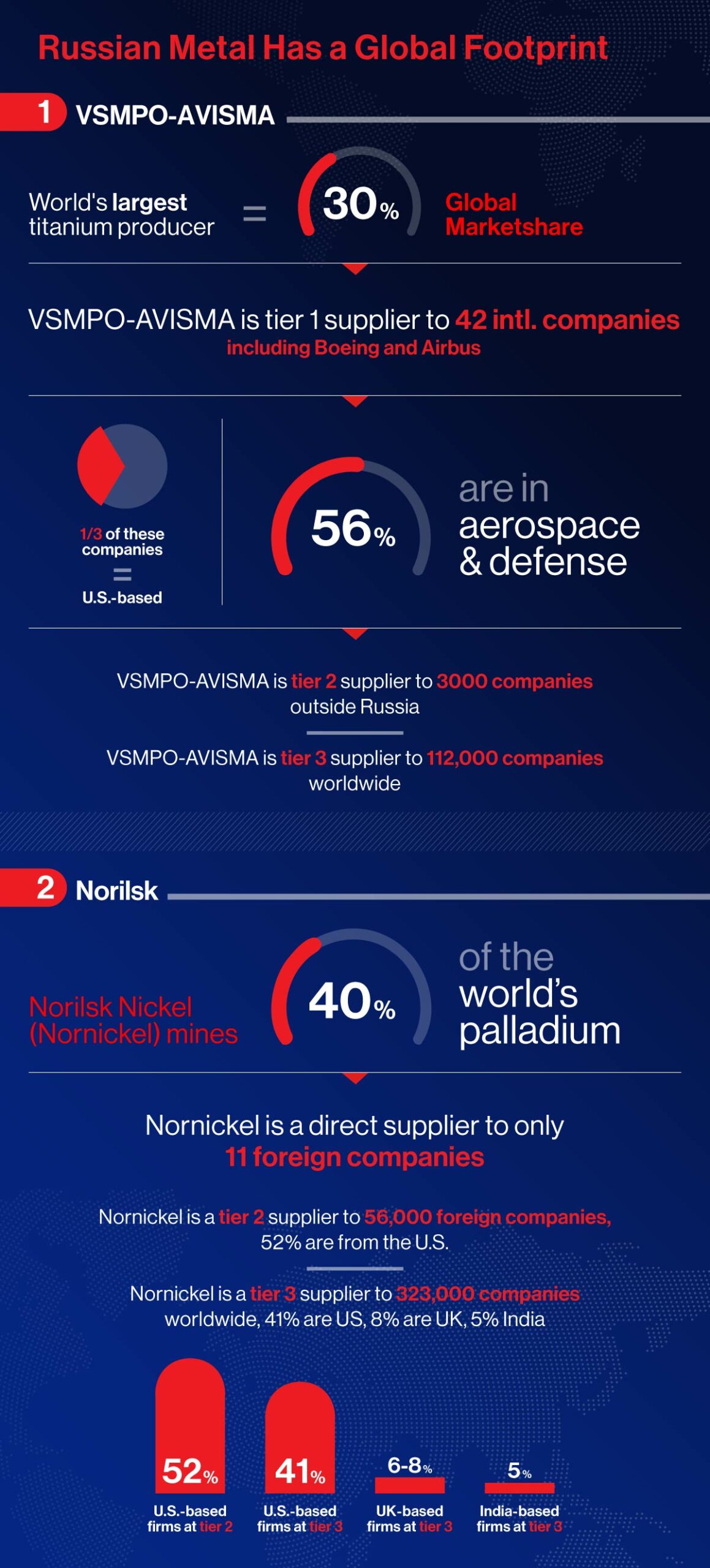

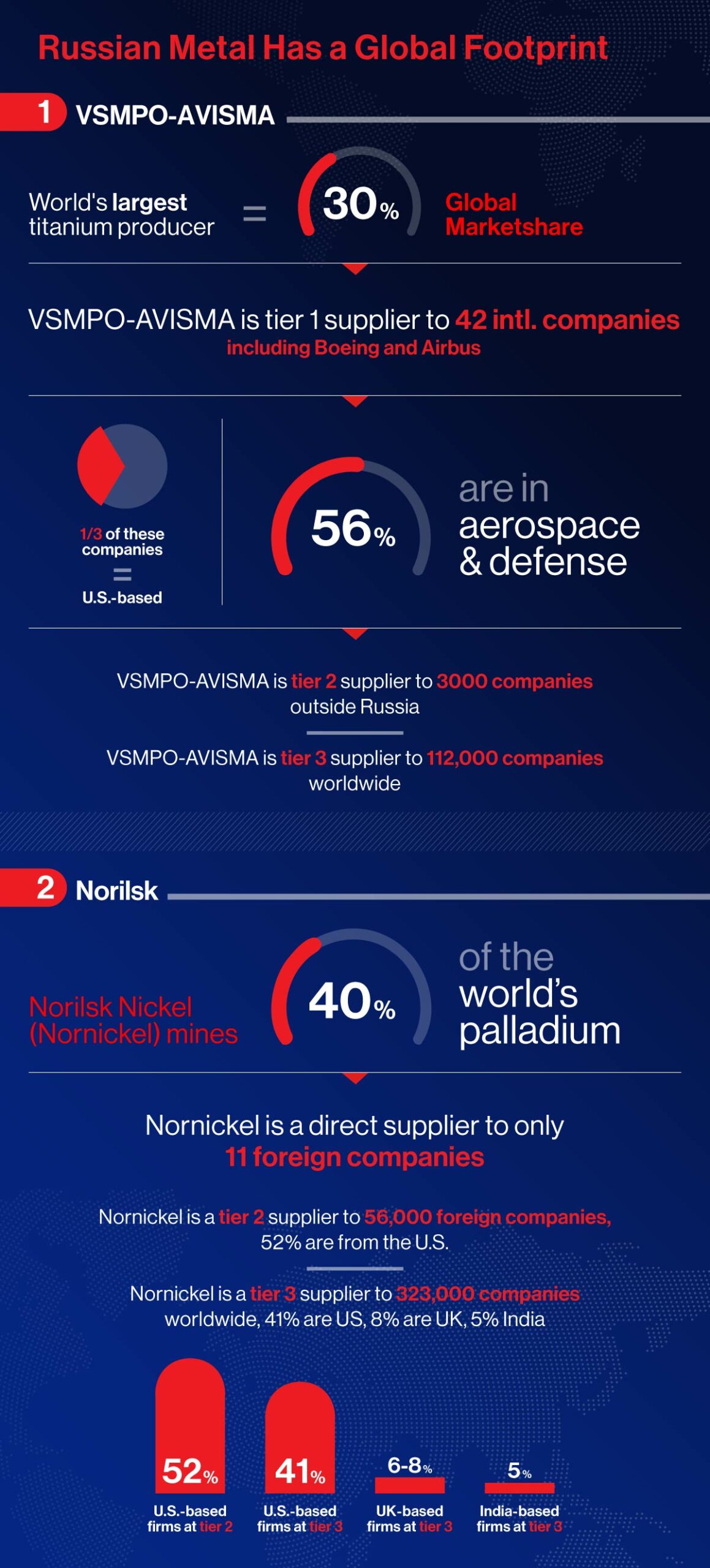

Analysis of Interos’ global relationship mapping platform highlights the following in respect of two major Russian-owned metals suppliers, for example:

- VSMPO-AVISMA, a subsidiary of Russia’s state-owned arms manufacturer Rostec, is the world’s largest titanium producer, with over 30% global market share. According to our data, it is a Tier 1 supplier to 42 international companies, including Boeing and Airbus. One-third of these are U.S.-based and more than half (56%) are in the aerospace & defense (A&D) industry.

- VSMPO-AVISMA and its subsidiaries are tier-2 suppliers to almost 3,000 companies outside Russia, including airlines and A&D firms. This group is also a tier-3 supplier to more than 112,000 firms worldwide, making industrial machinery, electronic equipment and other products.

- Norilsk Nickel (Nornickel) mines 40% of the world’s palladium – used in semiconductor manufacturing and catalytic converters to reduce vehicle emissions – and is a leading nickel producer used to make stainless steel and electric vehicle batteries.

- While Nornickel shows up in our platform as a direct supplier to only 11 foreign companies, it forms part of almost 56,000 supply chains at tier 2 and over 323,000 at tier 3. U.S.-based firms represent 52% of these connections at tier 2 and 41% at tier 3, with the UK accounting for a further 6-8% and India 5%.

Understanding foreign company dependencies

As well as understanding the domestic Russian producers they do business with, directly or indirectly, international customers also need to be aware of foreign-owned companies operating within the country.

To get a sense of these connections, the Interos Resilience Lab reviewed the list of over 400 major U.S., European, Japanese and other brands compiled by Professor Jeffrey Sonnenfeld and his colleagues at Yale University that have announced plans to leave, scale back, pause or stay in Russia.

Of the 50 companies we looked at with manufacturing-based supply chains, many operate within Russia to supply customers serving the domestic market. They include glass producers, industrial gases, bulk packaging, and tires – items typically made at a national or regional, rather than global, supply chain level. However, some of these companies also use the Russia supply chain as an export base.

Three illustrative examples:

- A sizeable U.S.-based conglomerate has more than 60 European or UK customers that it supplies directly from Russia. It also supports over 17,500 customers as a tier-2 supplier and 86,800 as a tier-3 supplier. The equivalent numbers of U.S. customers are significantly higher at all levels.

- An American metals producer with manufacturing operations in Russia supplies over 25,000 firms in the UK and Europe at Tiers 1-3, and over 57,000 in the U.S.

- A multi-billion industrial products manufacturer with a key subsidiary in Russia serves more than 175,000 customers at Tiers 1-3 in the U.S., and 95,000 in the UK and Europe.

Procurement and supply chain leaders need to understand these connections and dependencies, whether because these sources may be subjected to disruption over the coming weeks or because they wish to avoid purchasing from Russia.

For continued updates on the supply chain impacts of the war in Ukraine, please see our Ukraine Crisis Resource Center.