By Geraint John and Margaret D’Annunzio

The ongoing litany of supply chain disruptions is prompting many organizations to redesign their global supply networks to build resilience. New research published this week by Interos found that almost two-thirds (64%) of executives said their organizations planned to make “wholesale changes” to their supply chain footprints.

And it’s not only business leaders that are focusing on the need for greater supply chain resilience.

Heavyweight economic and political institutions are also weighing in on the issue and proposing a variety of (sometimes conflicting) solutions – as evidenced by two recent reports from the International Monetary Fund (IMF) and the U.S. government.

The latter’s “Economic Report of the President,” (Economic Report) published in April, devotes an entire chapter to “building resilient supply chains.”

This portion of the Economic Report robustly analyses the evolution of modern supply chains and discusses some of the failures associated with firms’ and countries’ increased reliance on outsourcing and offshoring.

The Economic Report suggests that some of main reasons for supply chain globalization since the early 1990s are: Greater access to foreign suppliers through IT advances and lower trade barriers; government subsidies for key manufacturing sectors; and short-term financial incentives for top executives.

It argues that although COVID-19 exacerbated supply chain risks and made them more obvious, the pandemic did not create the majority of vulnerabilities, nor will its end abate them.

“Because of outsourcing, offshoring, and insufficient investment in resilience, many supply chains have become complex and fragile,” the report notes.

Shining a Light on Concentration Risk

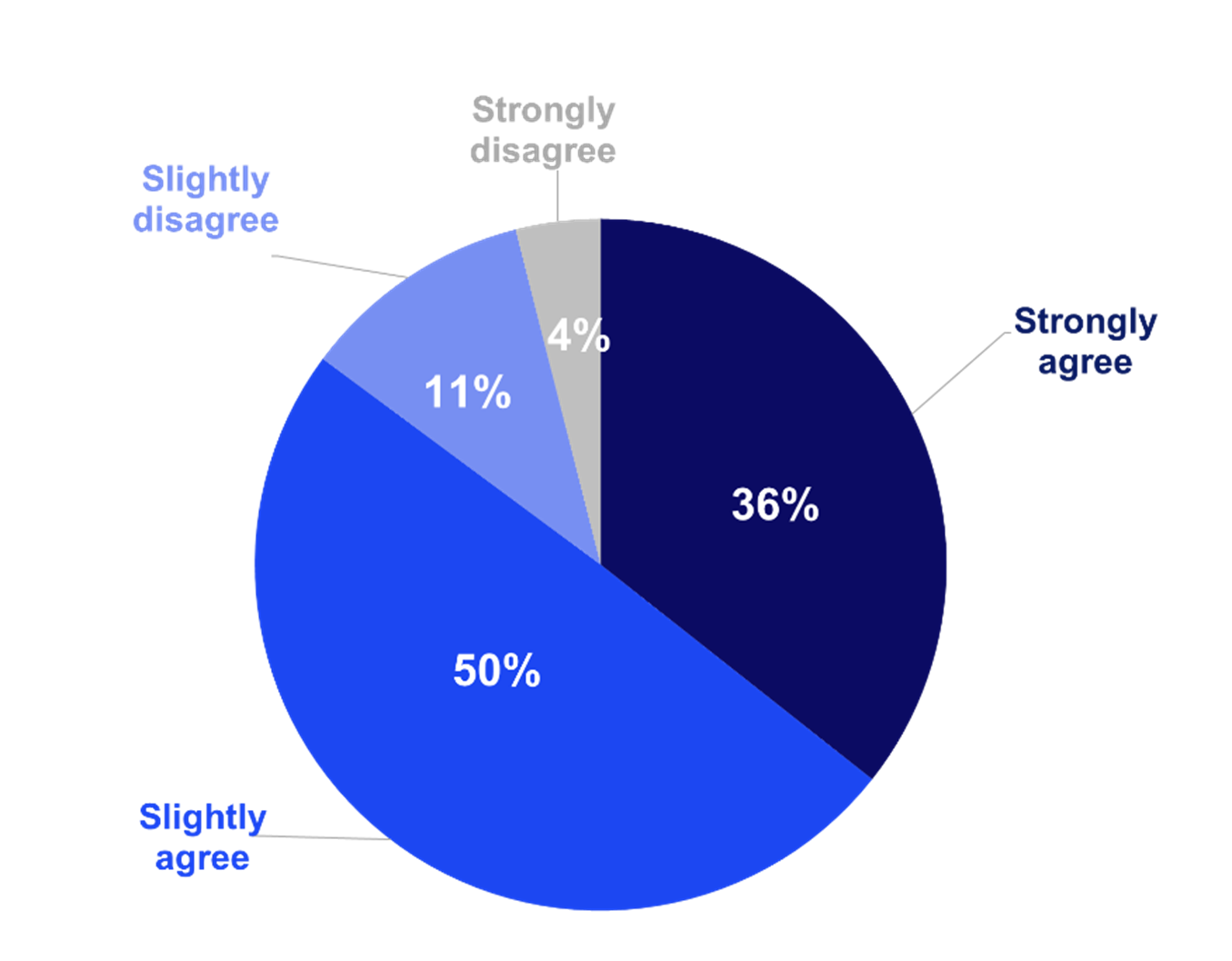

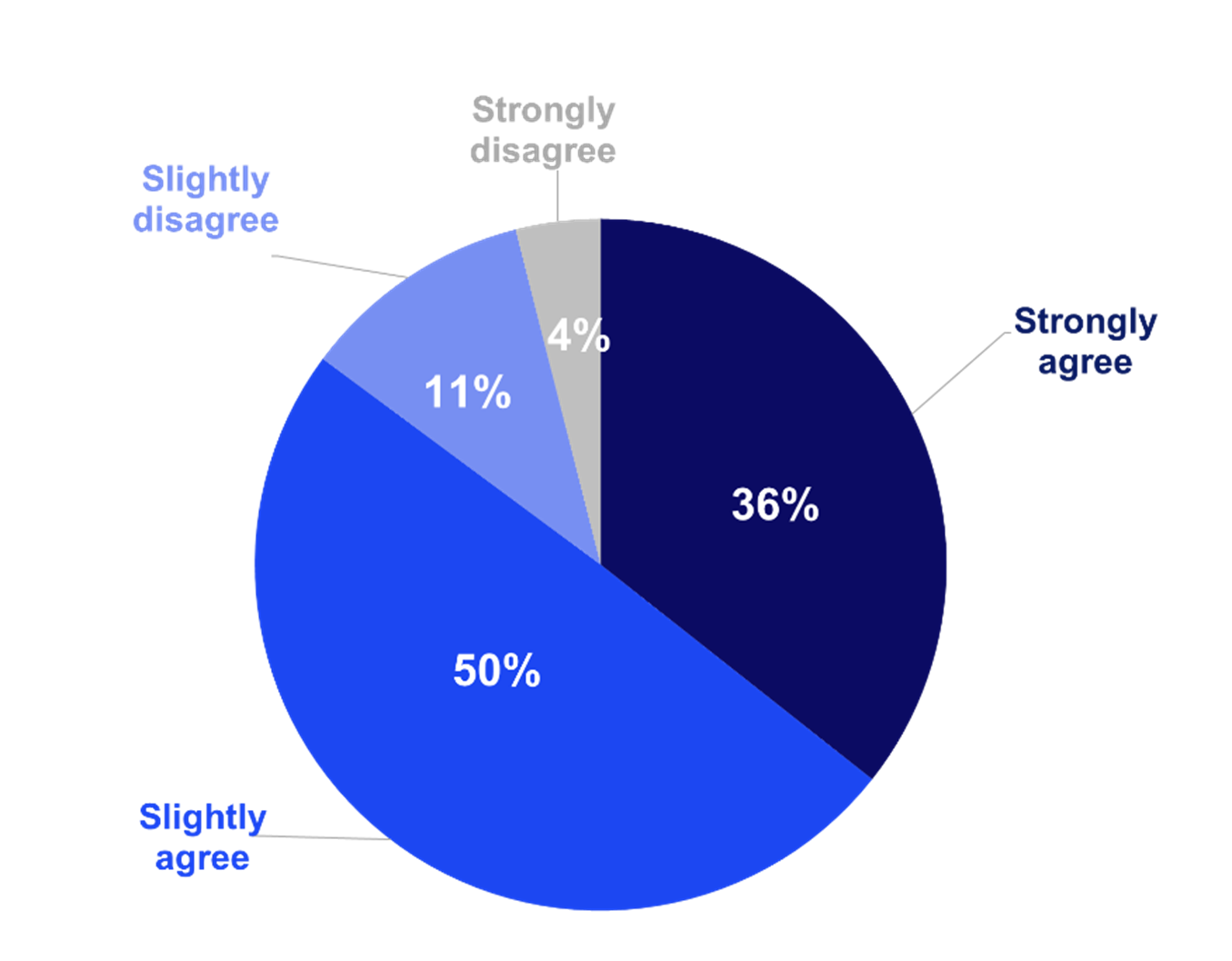

Interos’ own research found that concentration risk is of particular concern to senior supply chain executives. Almost 9 out of 10 of the 1,500 procurement, IT and IT security professionals surveyed by Interos in the first quarter of 2022 agreed they had too many suppliers located in one area of the world.

Concentration is a Big Concern

“My organization has too many suppliers concentrated in one area of the world and this is of concern to us”

n=1,500; Source: Resilience 2022: The Interos Annual Global Supply Chain Report

The White House report cites several examples of highly concentrated supply chains:

- Taiwan (and its dominant manufacturer Taiwan Semiconductor Mfg. Co. [TSMC]) produce 92% of the world’s supply of advanced semiconductors

- China manufactures 73% of lithium-ion batteries and has a 97% global market share of ingots and wafers used to make solar panels

- China also has a dominant position in the battery raw materials: lithium and cobalt, of which it refines 60% and 80% of global supply, respectively

Recent analysis of Interos’ global relationship mapping database found that while TSMC, as a contract manufacturer to the semiconductor industry, has a relatively small number of direct customers in the U.S. and Europe (Apple being the largest), its importance at tiers 2 and 3 is enormous.

And a new Interos report on rare-earth elements (REE) – which are also important inputs to computer chips and electric vehicles, among other products – noted that China controls 84% of the global market, with over 100,000 U.S. companies and more than 50,000 European firms having the top 21 Chinese REE suppliers in their extended supply chains.

Will Reshoring Really Bring Resilience?

One potential solution to fragile and concentrated global supply chains that gets plenty of airtime is reshoring production back to “home countries”.

Respondents to Interos’ annual survey said that, on average, they expected to reshore or nearshore around half (51%) of foreign supplier contracts in the next three years.

The White House’s Economic Report argues that “at least some domestic production of critical goods” such as semiconductors and batteries is required – in part for national security reasons.

However, the IMF, in its equally detailed analysis, takes a somewhat different view, noting that, on average, 82% of Western firms’ intermediate inputs are already sourced domestically. It argues that “policy proposals to reduce dependence on foreign suppliers, especially in strategic sectors… may be premature, if not misguided.” Instead, the IMF advocates greater diversification in international sourcing – that is to say, increasing the number of suppliers and locations used.

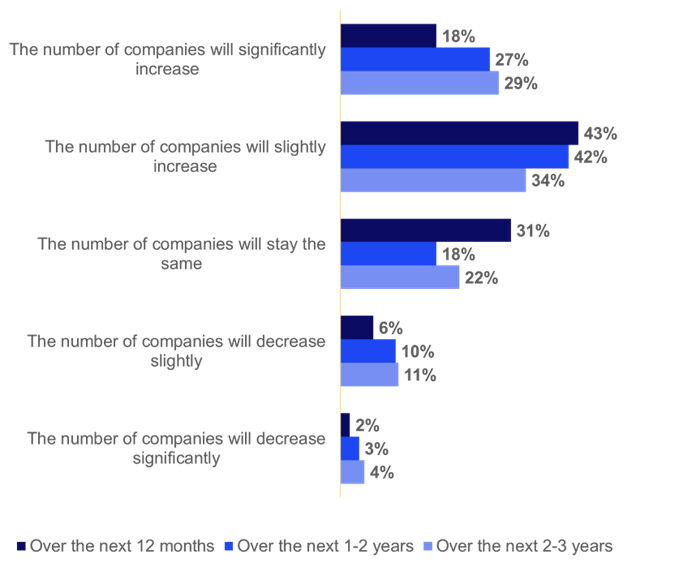

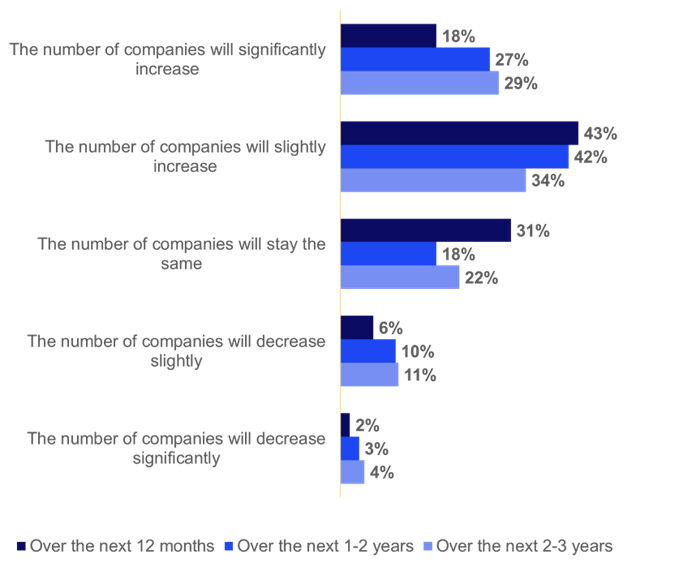

Interos’ survey findings appear to support this view, with more than 60% of executives saying their organizations plan to increase the number of firms in their supply chains over the next three years, compared with 15% or less that expect to reduce them.

Supplier Diversification is Happening

How the number of companies in organizations’ supply chains will change

n=1,500; Source: Resilience 2022: The Interos Annual Global Supply Chain Report

Even if managers do successfully make the business case for bringing product manufacturing back onshore, they still face a number of challenges – not the least of which is developing a local supply base.

French sportswear brand Salomon is a case in point. It decided to make its running shoes in a highly automated plant in France after many years operating in Asia, but found it was still reliant on suppliers of soles and other parts in China and Vietnam.

Improving Supply Chain Visibility & Resilience

Despite their differences, the IMF and White House reports do agree on some things. Chief among these, perhaps not surprisingly, is the need for government policy to support companies in their resilience-building efforts.

Interventions include:

- Improving transportation infrastructure, such as major ports

- Reducing international trade costs, and in particular non-tariff barriers

- Convening and coordinating firms to develop standards and find industry-wide solutions

- Aggregating and disseminating data that help companies better understand their supply chains

On this latter point, both reports emphasize the importance of supply chain visibility.

“Visibility into supply chain relationships is necessary to identify vulnerabilities in supply chains, so that firms can properly plan for disruptive events,” notes the White House report.

Interos’ survey found overwhelming support among executives for technology to solve this problem.

Although less than a fifth said their organizations were already using intelligent, automated solutions to understand interdependencies at multiple tiers, three-quarters expected to have such technology in place within the next 12 months.

To download a copy of Resilience 2022: The Interos Annual Global Supply Chain Report, click here.