By Kate Anderson

Hurricane Ian has caused massive damage to physical infrastructure on the east coast last week, shutting ports and terminals, and further disrupting already-strained US supply chains. Unfortunately, these kinds of weather-related supply chain disruptions are likely to become increasingly frequent. In recent years, hurricane season has become both longer and more intense, with a greater proportion of storms expected to reach Category 4 and 5 levels. NOAA recently projected that 2022 will be yet another above-average hurricane season, with an ongoing La Niña compounding the effects of global warming to increase the duration, frequency, and severity of North Atlantic hurricanes.

Hurricane Ian had devastating local effects, costing private Florida insurance companies an estimated $63 billion in damages—the most costly storm in Florida history. But that is just the tip of the iceberg. In the past few years, marine traffic has shifted away from the beleaguered west coast to the east coast. Some of the largest ports and transportation centers in the country were forced to shut down in anticipation of the storm, delaying shipments. These closures reverberate through supply chains, affecting businesses throughout the US and world.

A proactive approach to supply chain management requires that we heed the warnings of past events like Hurricane Sandy and Ian, to better understand the impact that a single storm could have on U.S. imports. This raises the question: If a major hurricane shut down all ports and terminals from Florida to Virginia, what could we expect to see in terms of supply chain impact? Answering this question requires visibility not only into the ports along the southeastern seaboard, but also the ripple effects as those disruptions propagate through the rest of the system.

Theoretically, What’s the Worst Possible Hurricane Supply Chain Scenario?

Maritime transportation accounts for a majority of U.S. imports and exports, with ports in Georgia, South Carolina, and Virginia among the largest importers on the East Coast.

We explored the potential impact of a theoretical catastrophic tropical cyclone event by looking at what types of commodities and U.S. firms would be impacted if all marine ports in Florida, Georgia, South Carolina, North Carolina, and Virginia were closed due to the dangerous conditions and damage that would come as a result of a severe hurricane.

The goods coming through southeastern ports range widely. Mechanical components make up the largest fraction. Electrical components are also heavily represented. Medical equipment and supplies, including vaccines, also come through southeast ports in volume. Consumer goods such as clothing, food, cars and motorcycles, and other consumer durables would also be affected.

Over 40,000 different companies shipped goods into ports on the southeastern seaboard during hurricane season last year, many of them receiving hundreds of individual shipments. The largest direct effects are on manufacturing. The largest among these are the transportation industry (automotives, airplanes, trains, roads, etc.) and aerospace and defense. The electronics industry would also be heavily affected, with further disruptions to the flow of crucial electronic components that are already proving in short supply.

Hurricane-Driven Disruption Could Have Even Larger Supply Chain Impacts

However, these numbers only represent the initial impact of the port closures. The events of the last few years have taught us that indirect effects can be just as disruptive to operations. Even if your business does not directly import items through Florida ports, you should still anticipate delays in the coming months due to Hurricane Ian. The reason is simple: If your suppliers are missing their shipments, then they are unable to provide you with the items you need for your operations. These “ripple effects” will impact a much larger fraction of the US economy than even the original event.

Proprietary Interos data allows us to look at the ripple effect of a severe weather event. Ports in the states affected by our theoretical storm serve over 40,000 companies. But according to Interos data, disruptions to operations in those companies would affect a further 243,000 additional companies. The situation is even more dire when we consider businesses yet another step out. 522,000 businesses would be affected at that level.

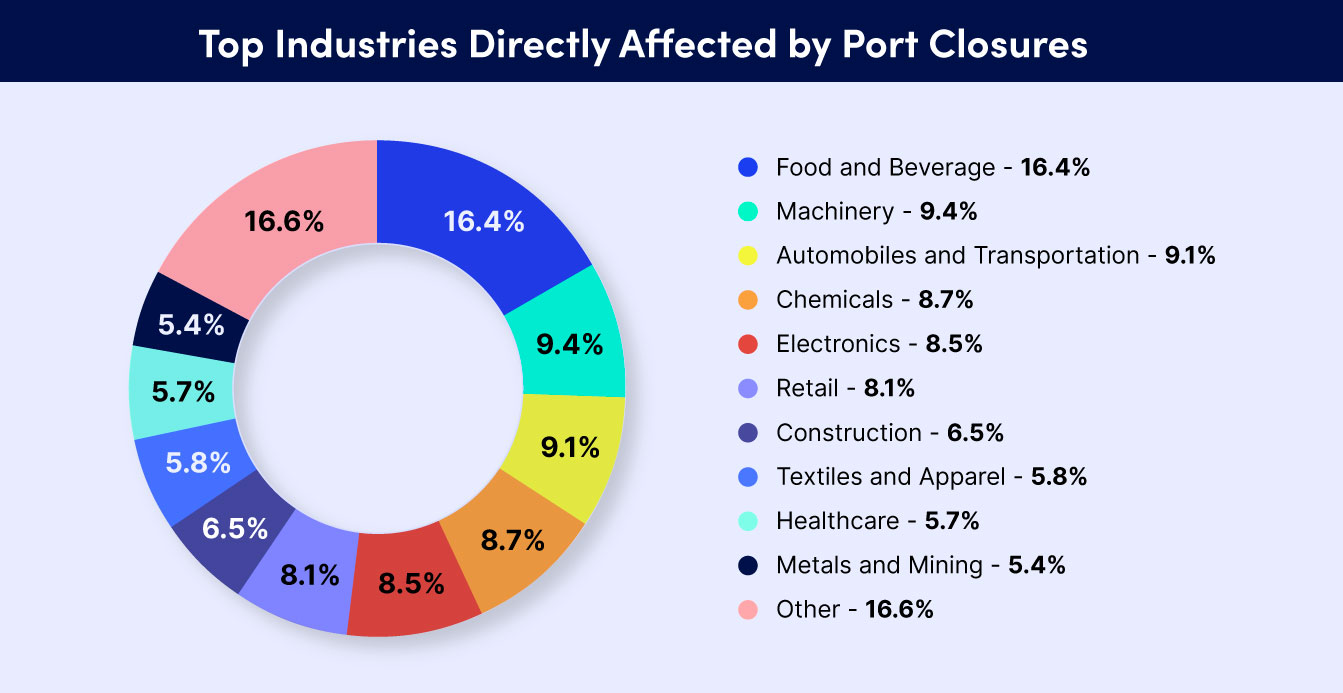

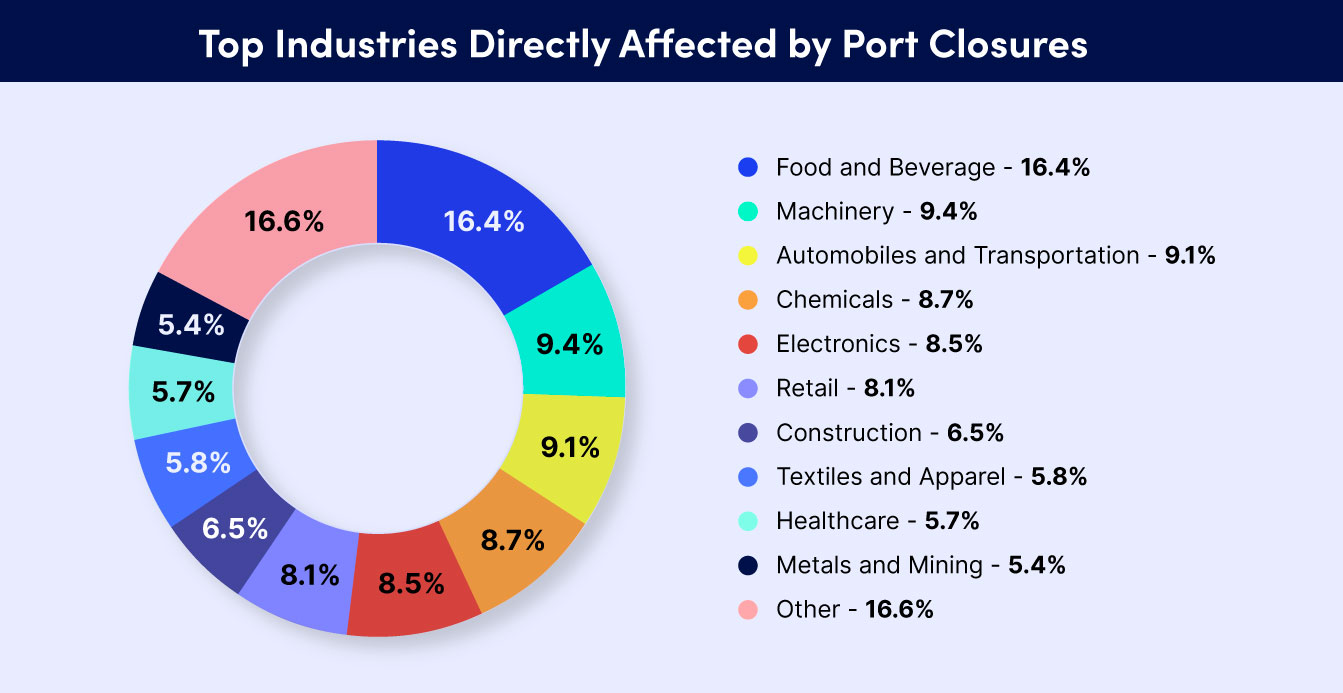

Our data also enabled us to take a look at different kinds of goods passing through the various ports affected by our hypothetical storm. We can use this to see which industries would be most affected by this potential disaster. While the food and beverage, machinery, and automotive sectors would be hit hardest, the chart below also highlights how widespread and potentially diverse the impact of major port closures along the US southeast would be.

Hurricane Ian will scarcely be the last major storm to shut down US trade infrastructure. Natural disaster-driven supply chain disruption is likely to only increase in severity and duration over the coming years – these impacts are no longer a matter of “if,” they are a matter of “when.” Organizations need to start developing effective contingency plans and disaster-preparedness measures to survive and thrive in this new environment of perpetual disruption. Of course, the best defense towards any disruption is a diverse and resilient supply chain. Achieving supply chain resilience first requires understanding the entirety of your supply chain, and the vendors and risks within it.

To learn more about how Interos can help you create total supply chain visibility and build operational resilience, visit our procurement solutions page. If you’re looking to better-understand the real impacts of supply chain disruption, check out our animated and interactive annual survey.