By Trevor Howe

As the Russian invasion of Ukraine continues, one of the biggest global impacts is unfolding through Russia’s natural gas exports — or the potential lack thereof. Namely, the relationship between Europe’s gas supply and Gazprom, a Russian state-owned enterprise (SOE), is a critical concern.

In late March, Russian President Vladimir Putin announced that natural gas deliveries from Public Joint Stock Company (PJSC) Gazprom would need to be paid for in rubles by “unfriendly states.” Notably, this decree contradicted an overwhelming majority of contracts (97%) that European companies already signed with Gazprom (and its subsidiaries or affiliates), which stipulated that Russia natural gas exports would be paid for in either euros or US dollars. According to the demand, buyers of natural gas would have to open accounts with Gazprombank and pay for deliveries in euros which would be converted into rubles.

While this could be interpreted as a breach of sanctions by some, the European Commission clarified that this process would not constitute a breach of sanctions so long as companies declared their contractual arrangements complete when payments were made in the agreed-upon currency in existing contracts.

Russian Gas Exports See Cutoffs to Bulgaria and Poland

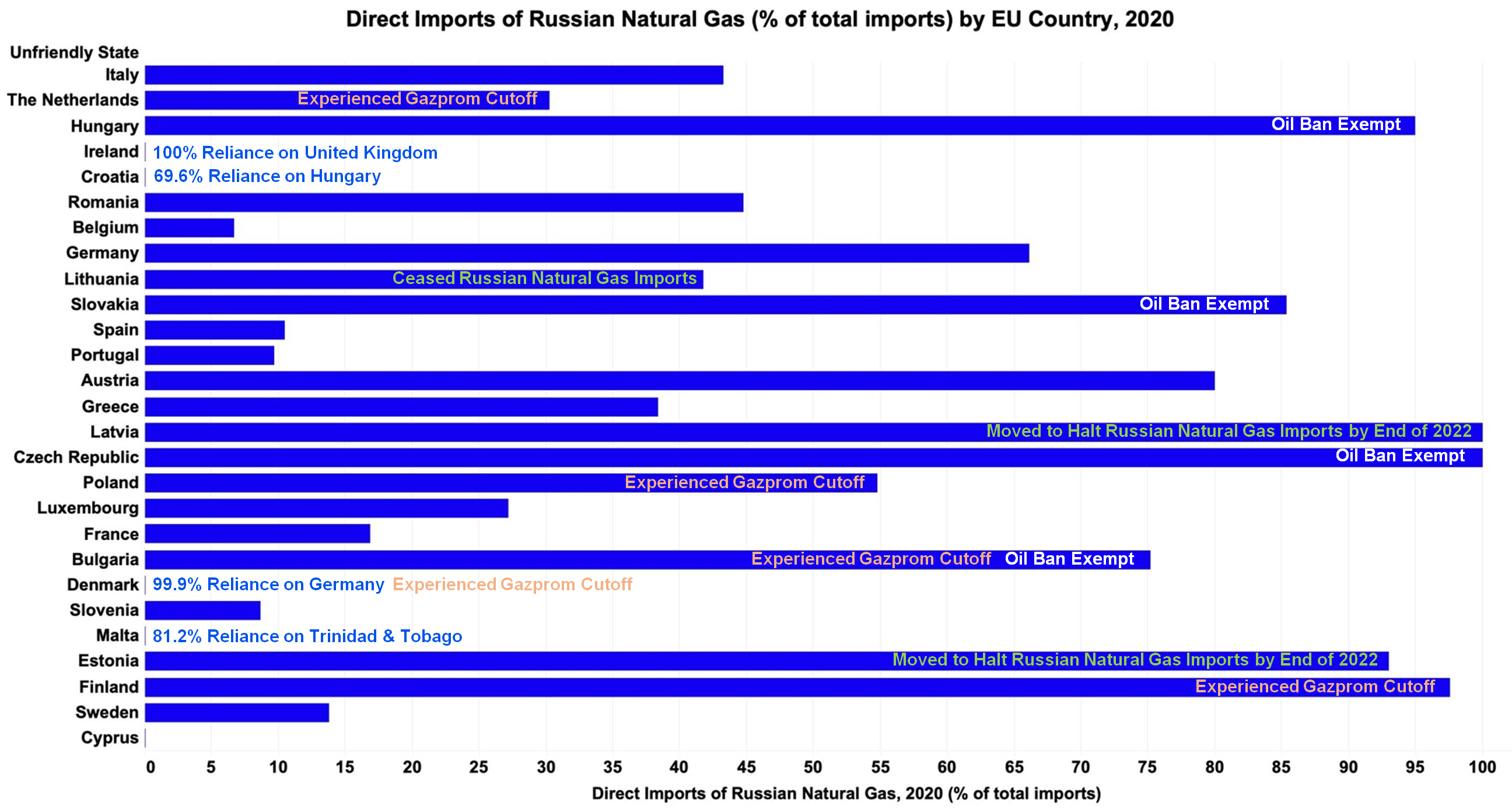

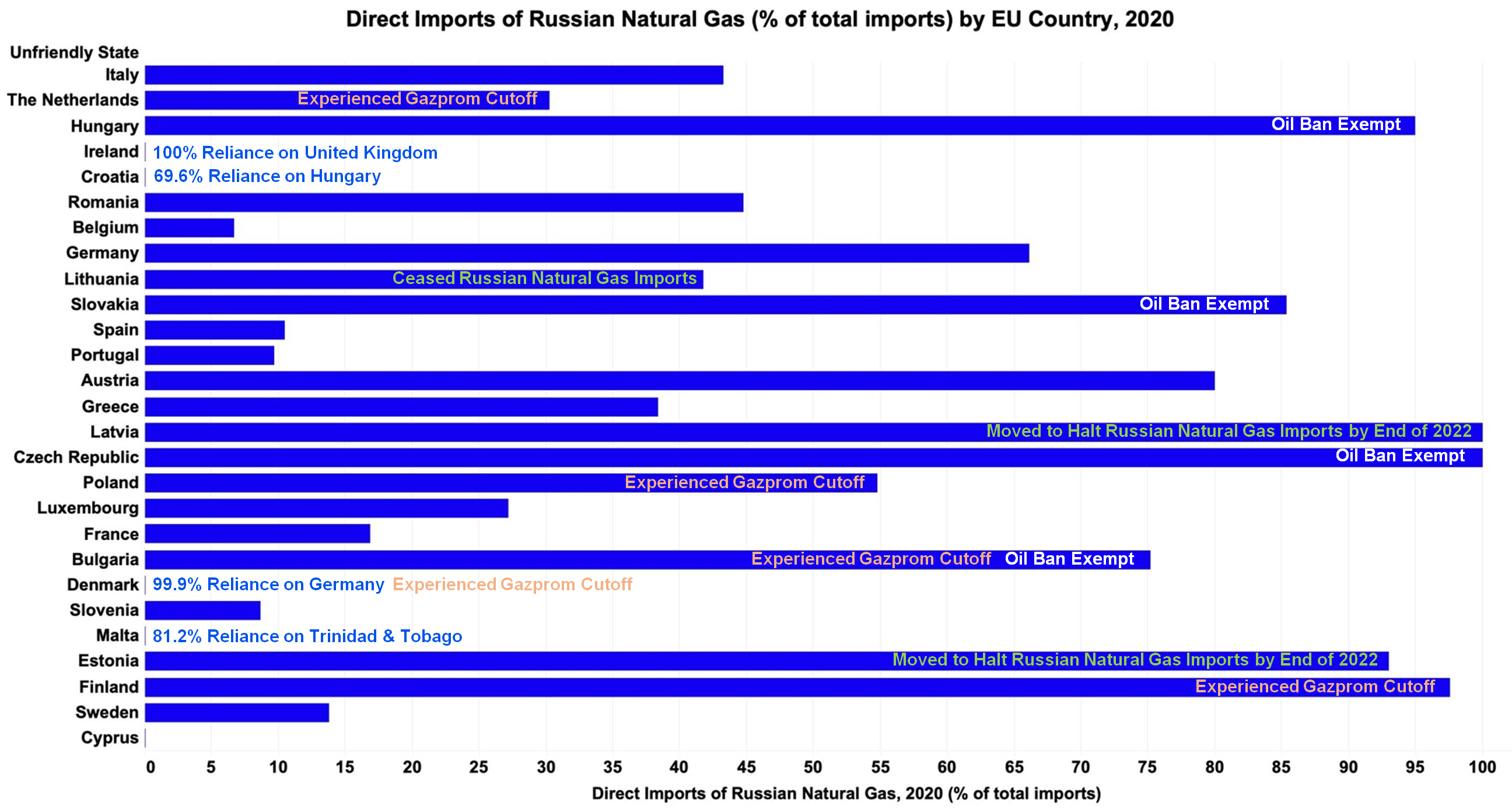

Despite this existing route for sanctions regime compliance, both Bulgargaz EAD in Bulgaria and Polskie Górnictwo Naftowe i Gazownictwo S.A. (PGNiG) in Poland rejected Gazprom’s new payment process. Notably, both had already decided not to extend long-term contracts with Gazprom, leading the Russian SOE to announce on April 27 that it would no longer facilitate natural gas flows to either county. However, because these markets were closing at the end of the year, this was widely interpreted as a low risk “shot across the bow” to demonstrate that the Kremlin was willing to act on its threats. Other current Russian threats include the further deployment of nuclear weapons in response to Western efforts to aid Ukraine and the potential for an expansion of the North Atlantic Treaty Organization (NATO).

American and European officials have highlighted the Kremlin’s operationalization of energy as a foreign policy weapon to attain desired geopolitical aims or influence through thinly veiled blackmail and coercion. To decouple from its reliance on Russian energy and build structural supply chain resilience, the European Commission has prioritized identifying and switching to non-Russian energy suppliers in the wake of Russia’s invasion of Ukraine. However, shifting supply sourcing presents itself as a technical, long-term process requiring reliance on infrastructural capacity that has not yet been developed both in Europe and countries like Algeria, which can supply the continent with liquefied natural gas (LNG) alternatives. A report published in April by the Interos Business Analyst Team has taken a closer look at this issue.

Gazprom Exports to Europe & Compliance with the New Payment Process

To cope in the meantime and to avoid further significant disruptions to global supply chains, several European companies have opted to comply with Gazprom’s new stipulations for the sale of Russia natural gas exports. Although a complete list of companies to open accounts with Gazprombank has not yet been made publicly available, the Deputy Prime Minister of the Russian Federation, Alexander Novak, stated the public will receive a new list in the coming days.

The Deputy PM stated that of the 54 European companies that Gazprom supplies, “about half of them have already opened accounts [in Gazprombank], one in foreign currency and one in ruble.” Companies which appear to have complied with the demand of payment for natural gas in euros to be converted into rubles include:

Non-Compliance with Gazprom’s New Payment Process

On the other side of the Gazprom Europe gas supply issue, the group of companies that have thus far refused to comply with Gazprom’s current ruble payment demand is under threat of natural gas cutoffs. On May 21, Russia suspended flows to Gasum Oy in Finland after a payment dispute. Clear geopolitical undertones were on display as Finland, in conjunction with Sweden, officially applied for membership to NATO just three days prior on May 18.

While Finland relies heavily on Russia for imports, natural gas only accounts for approximately 5% of the country’s annual energy consumption. While this limits the effect of the shutoff, industrial sectors rely on the energy source heavily. Chemical companies like Neste Oyj, forestry companies like Metsa Board Oyj, and other Finnish companies in the food industry will need to secure alternative sources to avoid disruptions.

Shortly thereafter on May 31, Gazprom announced additional flow shutoffs to three more European companies who refused to comply with ruble payment demands. Those were:

Companies of Interest

GasTerra B.V. is a partial Dutch SOE, Ørsted AS is a Danish energy company focused on sustainable energy through wind and solar farms, and Shell Energy Europe Limited is a UK-based supplier whose recent cuts will deprive German buyers of 1.2 billion cubic meters per annum (bcma) of natural gas.

According to Eurostat, in 2020 the Netherlands relied on natural gas for 37.6% of its total energy consumption, importing 45% of consumed gas to meet demand. Of that 45%, roughly 30.3% came from Russia. Although this has exposed the country to vulnerabilities from Russian supply, the country appears to be taking steps to lessen industrial reliance on natural gas and to fill storage facilities ahead of next winter to 70% levels to avoid supply gaps.

While Denmark has experienced natural gas shutoffs, the country does not appear to import from Russia directly. Instead, according to Eurostat in 2020 Denmark imported 99.9% of natural gas from Germany, a country that imported 66.1% of its gas from Russia. While natural gas consumption in Denmark accounted for approximately 12% of total energy consumed in 2020, the country plans to quadruple green power production by 2030. This will boost green gas and temporarily hike domestic natural gas production to offset Russian imports as the country phases out natural gas.

Companies at Risk of Cutoffs from Gazprom

- Companies that refuse to comply with Gazprombank’s new payment process.

- Companies located in countries or territories the Kremlin deems “unfriendly.”

- Companies with Gazprom supply contracts that expire this year which they have not extended or renewed.

Along with these metrics, one example of a company under potential threat of a cutoff from Russian natural gas exports is Edison S.p.A., an Italian company with a Gazprom contract for 1 bcma that expires this year. It appears the company will not seek to renew. As part of the European Union (EU), Italy is included in the Kremlin’s unfriendly states list. Edison also appears to be shifting away from Russian natural gas in favor of American LNG with a deal the company signed in 2017 to supply 1 million tons per annum from the Calcasieu Pass LNG export facility in Louisiana.

According to Interos data, Edison S.p.A. is a direct supplier for 69 companies worldwide. Although the company anticipates deliveries from Calcasieu soon, commercial operations from the Louisiana facility are not expected to begin until Q4 2022 or Q1 2023. Were cutoffs to occur soon against Edison, its operations could be disrupted for weeks if the company cannot secure interim supplies quickly. Therefore, this scenario could have adverse ripple effects in the supply chains that connect to Edison. In the case of cutoffs to Bulgaria and Poland, Gazprom already demonstrated its willingness to forgo a couple of months of revenue from a single buyer they would lose anyway to gain credibility to reinforce Gazprom’s threats against European gas supplies.

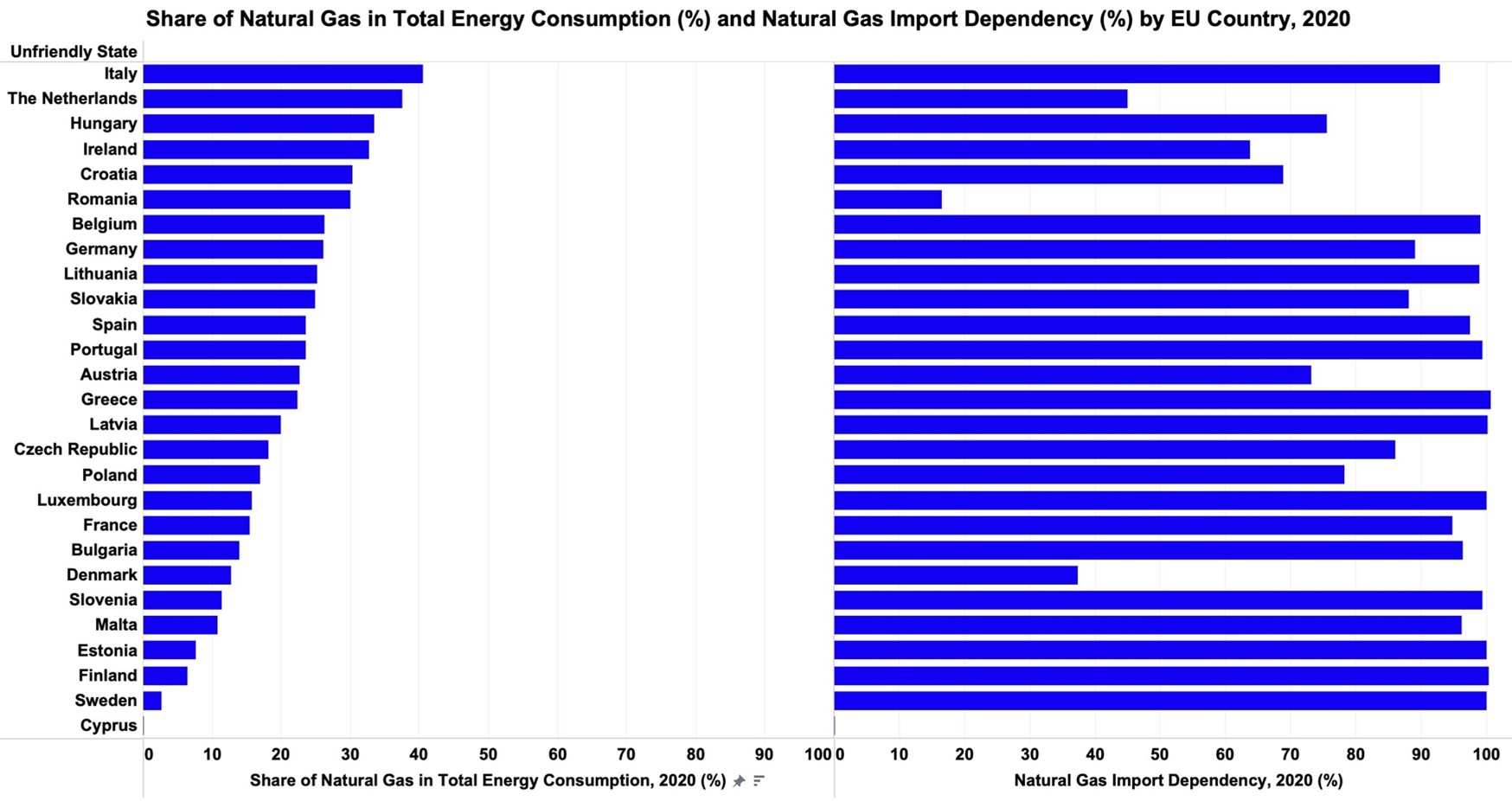

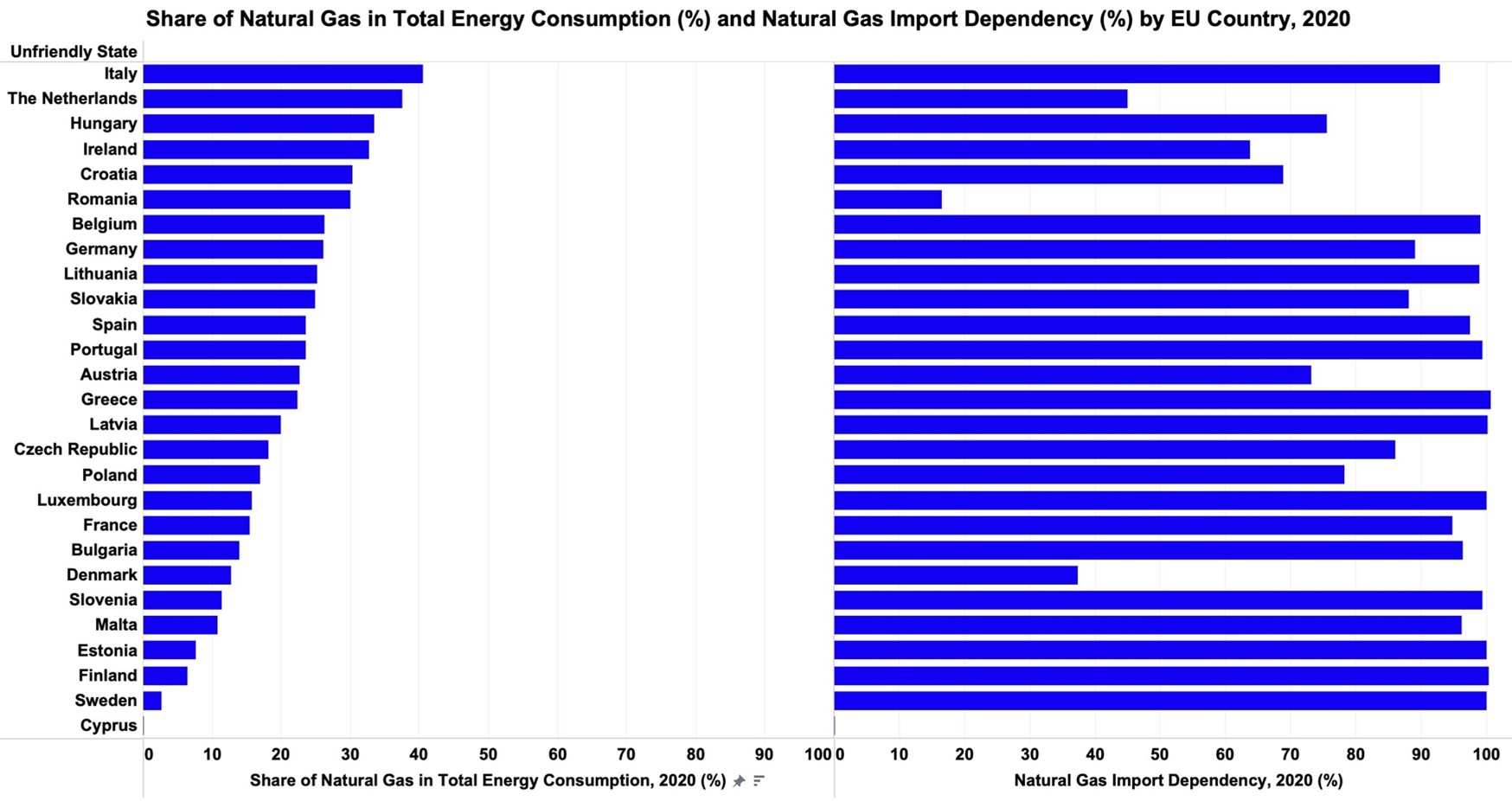

Cutoffs to Italy from Russia would be significant. In 2020, natural gas accounted for 40.5% of all energy consumption in the country, the highest of all EU countries. In the same year, Italy was 92.8% reliant on natural gas imports, 43.3% of which came from Russia. This dependence underscores the country’s vulnerability to any Russian gas shutoff, making the Gazprom Europe gas supply crisis more pressing.

Natural Gas Consumption, Imports, and Russian Reliance of EU States

In 2020, the EU’s energy mix consisted of 35% oil and petroleum products, 24% natural gas, 17% renewables, 13% nuclear energy, and 11% solid fossil fuels. Natural gas is a significant fuel for electricity production and household heating, and it also serves as a vital input to multiple highly energy-intensive manufacturing sectors. Of all energy sources, natural gas is the fuel with the highest exposure to imports from Russia. In 2020, the EU received 46% of its natural gas imports from Russia to satisfy 41% of gross available energy derived from natural gas.

Meanwhile, regional production has played a diminishing role in satisfying European natural gas needs over the past decade, which has made Gazprom’s disruption of European gas supply more urgent. From 2010 through 2020, natural gas production in the EU and the UK declined by more than 50%, from 18 billion cubic feet per day (Bcf/d) in 2010 to 9 Bcf/d in 2020. This significant decline has resulted from resource depletion and government initiatives to fully phase out natural gas production in favor of other sources such as solar and wind.

As a result, Italy is not alone in its vulnerability to vacillations in the Russian natural gas supply; in 2020, Russian natural gas exports served as 25% or more of overall natural gas imports for at least 16 EU countries, according to Eurostat.

Currently, Romania imports less natural gas than most other EU countries. Moreover, the development of the Black Sea gas fields would make Romania the European Union’s biggest natural gas producer. In 2020, Romania published a new strategy document emphasizing an increase in gas-fired power generation across the country, mainly as an implicit shift from coal to natural gas in the power generation sector.

While the EU has yet to target Russian natural gas in its waves of sanctions, the bloc has recently agreed to an embargo on Russian crude oil imports that will take effect by the end of 2022. The ban aims to halt 90% of imports by the end of the year, but to achieve required consensus the ban notably provided carveouts to Hungary, Slovakia, and the Czech Republic. Bulgaria was also given an exemption which will last until the end of 2024.

All four countries have an entrenched reliance on Russian exports of oil and natural gas, which is why they originally resisted the EU ban, citing severe economic consequences. Exemptions for these four countries comprise the remaining 10% of imports not covered by the ban. Moreover, the effort revealed divisions within the bloc on the issue of Russian sanctions, which could be exacerbated were Russian natural gas to be targeted next.

Perhaps the most significant progress in weaning off Russian gas can be seen in the Baltic States. Lithuania became the first European country to stop using Russian gas entirely. Although heavily dependent upon Russian gas, Latvia moved to end its reliance by the end of 2022, and Estonia’s government has likewise motioned to stop imports by the end of 2022.

Natural Gas-Intensive Industries at Risk of Disruptions

Several highly energy-intensive manufacturing sectors rely predominantly upon natural gas as the main energy carrier and thus particularly are exposed to inflated production costs in times of constrained supply. Those increased costs could serve as financial barriers to operations.

High energy-intensive sectors relying on natural gas include:

- Manufacture of clay building materials

- Manufacture of pulp, paper, and paperboard

- Manufacture of glass and glass products

- Manufacture of basic iron and steel and of ferro-alloys

- Manufacture of man-made fibers

- Manufacture of refractory products

- Manufacture of basic chemicals, fertilizers and nitrogen compounds, plastics, and synthetic rubber in primary forms (In 2016, nitrogen fertilizer plants were the most natural gas intensive plants)

- Manufacture of abrasive products and non-metallic mineral products n.e.c.

- Manufacture of other porcelain and ceramic products

A recent report published by the Interos Business Analyst Team already identified that within German industry, chemical manufacturers, in particular, would be vulnerable to constrained supplies of natural gas in the event of further cutoffs affecting the country. German industry is already bracing for gas rationing as government policies have given priority to households in the event of constricted supply.

Other countries that could be vulnerable to disruptions in the event of constrained supplies of Russia natural gas exports include:

Austria

In 2020, Austrian industries accounted for 41% of natural gas consumption, up from 36% in 2010, with power plants accounting for 26%. With a current 80% reliance on Russia for natural gas, Austrian industries would be devastated if taps were to be shut off abruptly. The Austrian paper milling industry in particular is dependent on natural gas for 35% of energy needs, which, if disrupted, would also have negative supply chain effects for paper-based hygiene products. Thus far, the Austrian company OMV has complied with Gazprom’s new payment scheme to avoid flow disruptions to Europe’s gas supply.

Romania

In 2019, Romanian industries accounted for 36.1% of natural gas consumption. The following year, Romania’s top exports were vehicle parts, cars, insulated wire, electrical control boards, and rubber tires, which could be undermined with constrained gas supply. Romania’s energy minister, Virgil Popescu, stated that the Romanian state does not have direct contracts with Gazprom, but rather natural gas is supplied to the country by intermediaries who bring in Russian gas.

Concluding Remarks on Russia’s Natural Gas Exports

LNG alternatives will be crucial in achieving the bloc’s goal of weaning off reliance on Russian natural gas. Europe has been the top export destination for American LNG for the past several months amid Russia’s invasion of Ukraine. However, American LNG exports will not completely replace Russian gas, and ramping up LNG production and exports comes amid pushback from those citing climate concerns that could deviate the current administration from its stated goals.

To provide insights amidst an environment of uncertainty, the Resilience Analytics portion of the Interos Resilience platform can highlight suppliers that are vulnerable to a Russian energy shutoff. This portion of the platform is linked directly with our data lake and allows users to filter their three-tier ecosystem by entity name, location, industry, or risk scores. Using these filters, platform users can identify which suppliers are direct or indirect Russian energy consumers. Once these connections are found, the data can be exported as an image, .pdf, or raw data extracted to be analyzed and viewed outside the Resilience platform. To learn more about Interos, visit interos.ai.