By Patrick Van Hull

Throughout our webinar, “Banking on Security: Unraveling the Secrets of Proactive Resilience in Third-Party Risk Management,” Chris Ballantyne of TD Bank, Michael Nassar of Deloitte, Jennifer Bisceglie, CEO and founder of Interos, and I delved into the landscape of managing third-party risks and the wide range of opportunities for financial services leaders to realize the value-generation opportunities of TPRM.

The financial services sector faces an ever-shifting panorama of risks, demanding a proactive stance to stay ahead. Traditional approaches are no longer sufficient; organizations must embrace real-time monitoring and continuous risk assessment. Disaster recovery and business continuity planning must evolve to encompass new risks and scenarios.

This transformation entails shifting from defensive to offensive strategies, focusing on mitigation, and adopting digital supply chain programs to develop comprehensive approaches to risk management.

Harnessing Data and Advanced Analytics for Effective Risk Management

Improving data quality and adopting advanced analytics and AI are central to this journey. These transformative tools streamline processes, enhance predictive capabilities, and enable proactive handling of third-party breaches. Organizations can swiftly identify and mitigate risks by leveraging external market intelligence and internal data analytics, bolster operational resilience, and protect against potential costs.

A clear majority of poll respondents in the webinar audience selected combining internal and external data to enhance risk assessment as a critical way to ensure technology and data integration in TPRM programs for maximum effectiveness.

The TPRM approach at TD Bank, according to Chris, also includes that sentiment: “We’ve been looking at how we can leverage data more effectively, both internal data and external data that are available, but also our suppliers and their supply chain, to figure out and triage an event more effectively, respond faster, and address them in a more timely manner to quickly shut down where that risk exists within our supply chain.”

Technology’s Influence on Operational Resilience and Compliance

Technology is both a boon and a challenge in the quest for operational resilience and regulatory compliance. While regulatory changes pose hurdles, they also spark innovation opportunities. Integrating commercial technology facilitates the transition from mere visibility to actionable insights, navigating the complex terrain of compliance while progressing along the industry’s maturity curve.

Nearly half of the webinar poll responses selected continuous compliance monitoring and management to encourage ongoing alignment with evolving regulations and industry standards in TPRM, with Michael’s thoughts expanding further: “to actually focus on that proactive element and respond with more agility and efficiency and effectiveness to the evolving threat landscape to the increase in incidents from third parties that is only going to frankly be impressive as a practice to regulators because it allows you to respond, assess, triage and action those incidents more quickly than you ever could before.”

Cultural and Technological Alignment

Crucially, this transformation necessitates alignment with cultural and technological shifts. Third-party risk management must become ingrained within organizational culture, grounded in data, and demonstrate tangible business value. Initiatives should start small but aspire to grand visions, moving beyond reactive approaches to emphasize proactive intelligence-driven decision-making.

As Jennifer puts it, there’s growing momentum toward “how do I do my day job faster, better, quicker, more efficiently, repeatable, and predictable? So, I don’t have to defend why I made the decision. I’m more focused on what I’m going to do with that decision. And that’s really been the big material change.”

Along the lines of that thought comes the fostering of a culture of shared responsibility for risk management, which was the most selected response to the poll question about how organizations can collaborate to embed TPRM capabilities into their culture effectively.

Setting a Path Forward

As Chris, Michael, and Jennifer see it, this journey toward resilience begins with mastering third-party risk management, which is not merely necessary for the future but is also a strategic imperative for financial institutions. Risk management may not be one-size-fits-all, but several core capabilities are essential in the path forward, including:

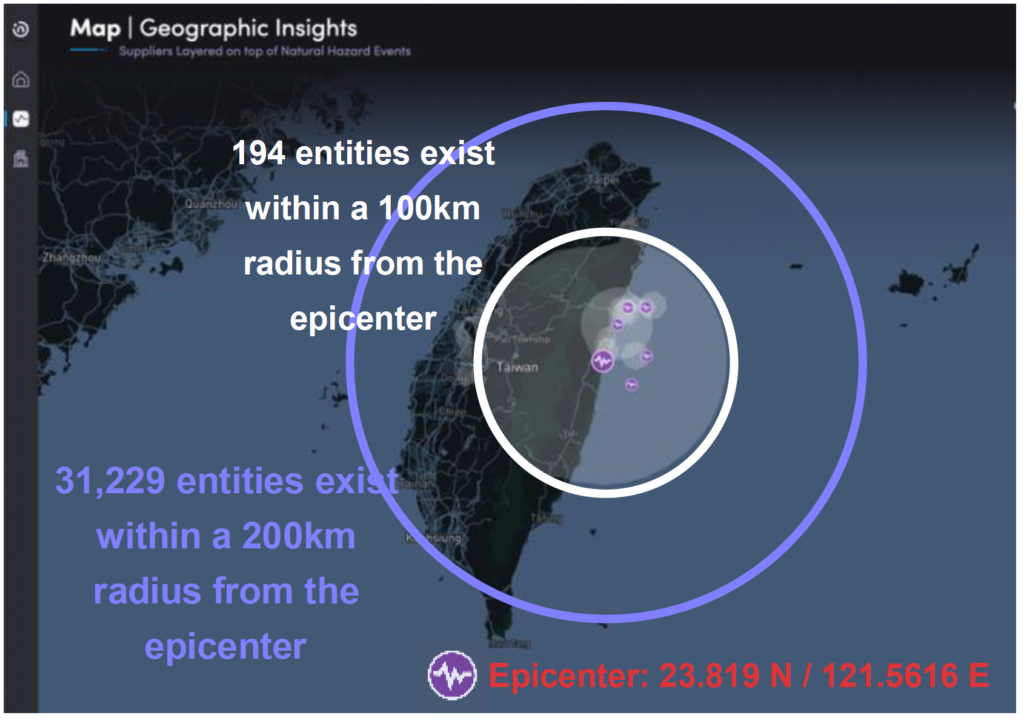

- Building visibility by mapping third-party ecosystems to quantify risk exposure and continuously monitor critical indicators.

- Leveraging trustworthy data intelligence combining internal and external sources to understand risk materiality.

- Demonstrating actionability and agility in making decisions without compromising on risk.

To progress through ongoing expectations of uncertainty and rapid change, organizations must confidently navigate the turbulent waters of disruption and emerge stronger by embracing proactive resilience, leveraging technology, and fostering cultural alignment.

Watch a replay of the webinar here.