By Geraint John

Global sales of electric vehicles (EVs) hit the accelerator pedal last year, with their market share speeding past 10% of new car registrations in the first half of 2022.

That’s great news for the planet, since passenger cars account for more than 40% of total carbon dioxide emissions annually worldwide, whereas EVs emit zero.

But from a supply chain perspective, the rapid growth of EV sales poses two particularly significant and worrisome challenges:

- The supply of key raw materials used to make rechargeable lithium-ion (Li-ion) batteries – the most important component in every EV – is not expected to keep up with demand.

- The processing of these raw materials and battery production are both dominated by China, at a time when geopolitical tensions are rising and developed economy governments want to reduce their strategic dependence on the country.

The importance of building a strong EV supply chain strategy

In recent months, the CEOs of several auto makers, including Tesla, Rivian and Stellantis, have spoken out about a looming supply shortage of Li-ion batteries during the next 3-5 years – one potentially far worse than the current semiconductor crisis.

Their concerns center around a projected deficit in the availability of lithium and cobalt – two of the main ingredients in battery cells – along with a lack of future capacity to refine these materials and manufacture the much higher battery volumes required.

Last week, the world’s biggest producer of lithium for EV batteries warned of a tight supply market for the rest of this decade.

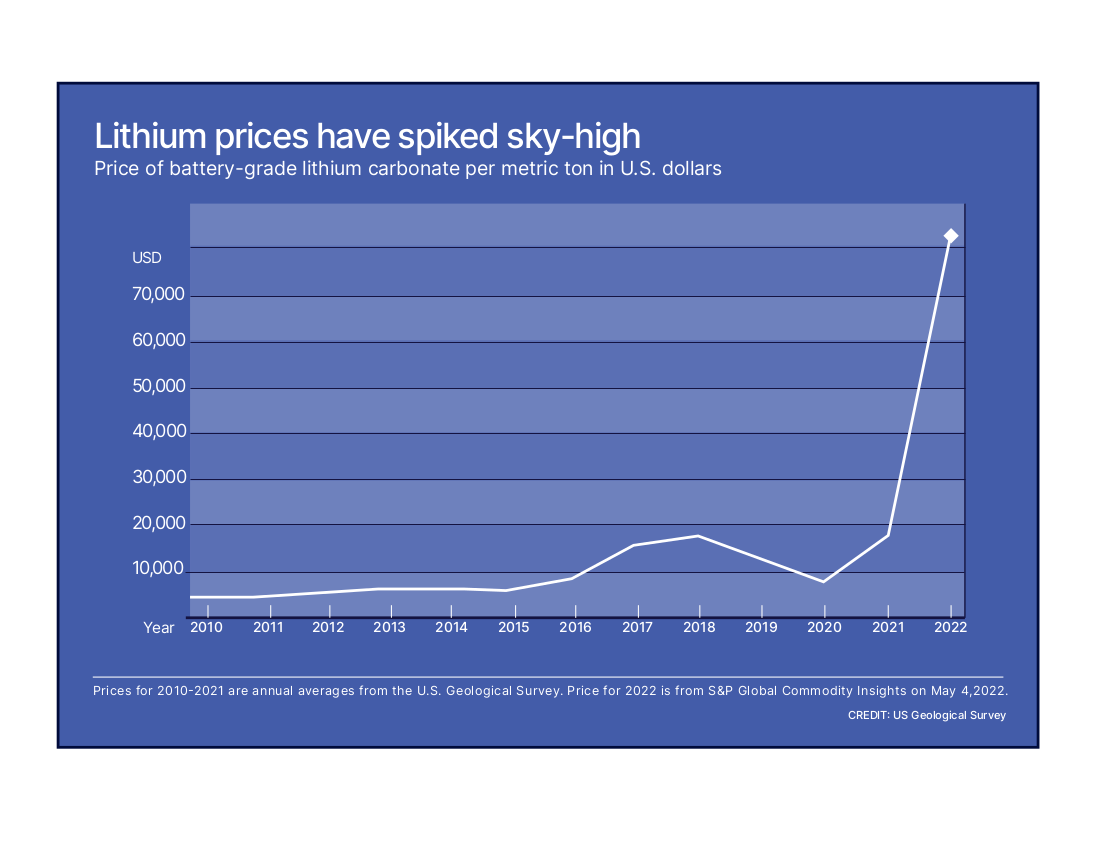

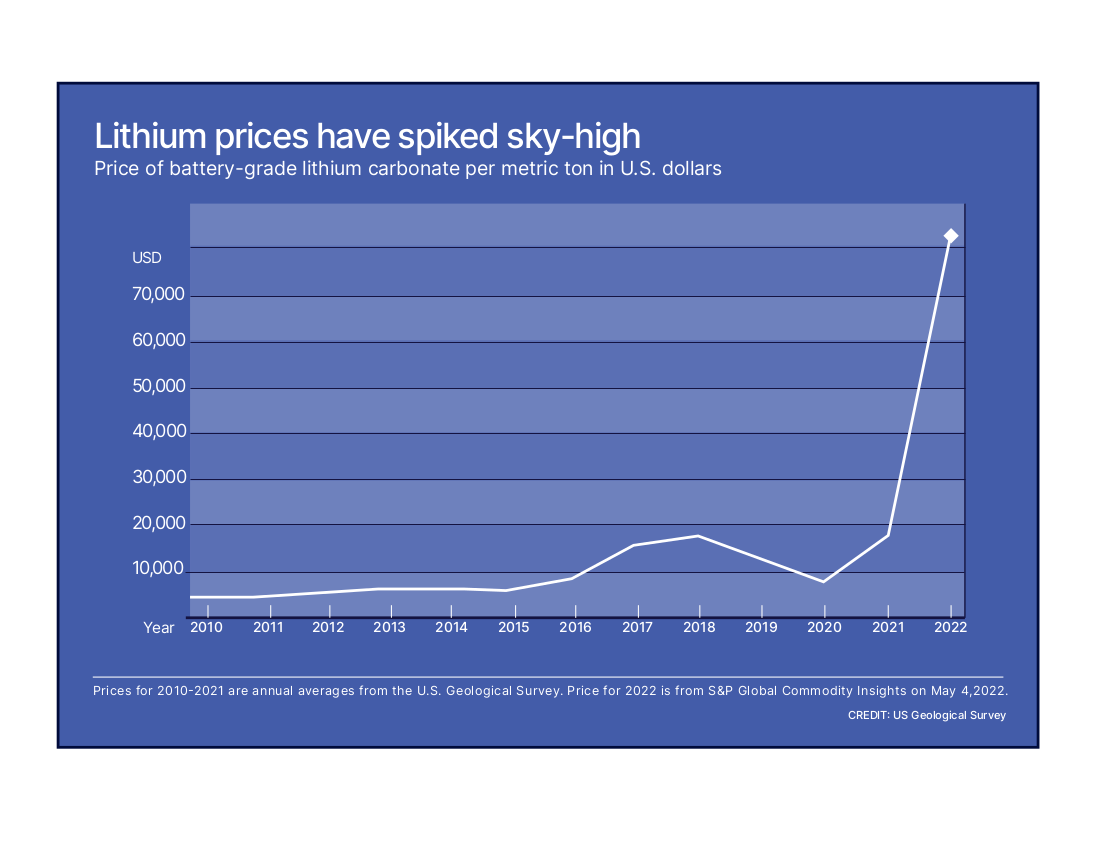

High demand and constrained supply have already caused significant raw material inflation, particularly for lithium. Prices for battery-grade lithium carbonate are up 375% year on year, and 116% in 2022, according to Benchmark Mineral Intelligence (BMI).

Raw materials now make up 80% of the cost of a Li-ion battery, reports BMI – double the share in 2015.

This has forced auto makers to raise list prices for EVs, and at least temporarily halted the notion that lower battery costs will make EVs more affordable for consumers.

The EV battery supply chain is dependent on China and Russia

Concentration risk is also a major concern. The latest global mining data shows that extraction of cobalt, graphite and lithium are highly concentrated in the Democratic Republic of the Congo (DRC), China and Australia respectively, based on the Herfindahl-Hirschman Index.

The DRC, which produces 70% of the world’s cobalt supply, is tainted by the use of child labor. And the second biggest source of cobalt is Russia, which is also the leading producer of battery-grade nickel.

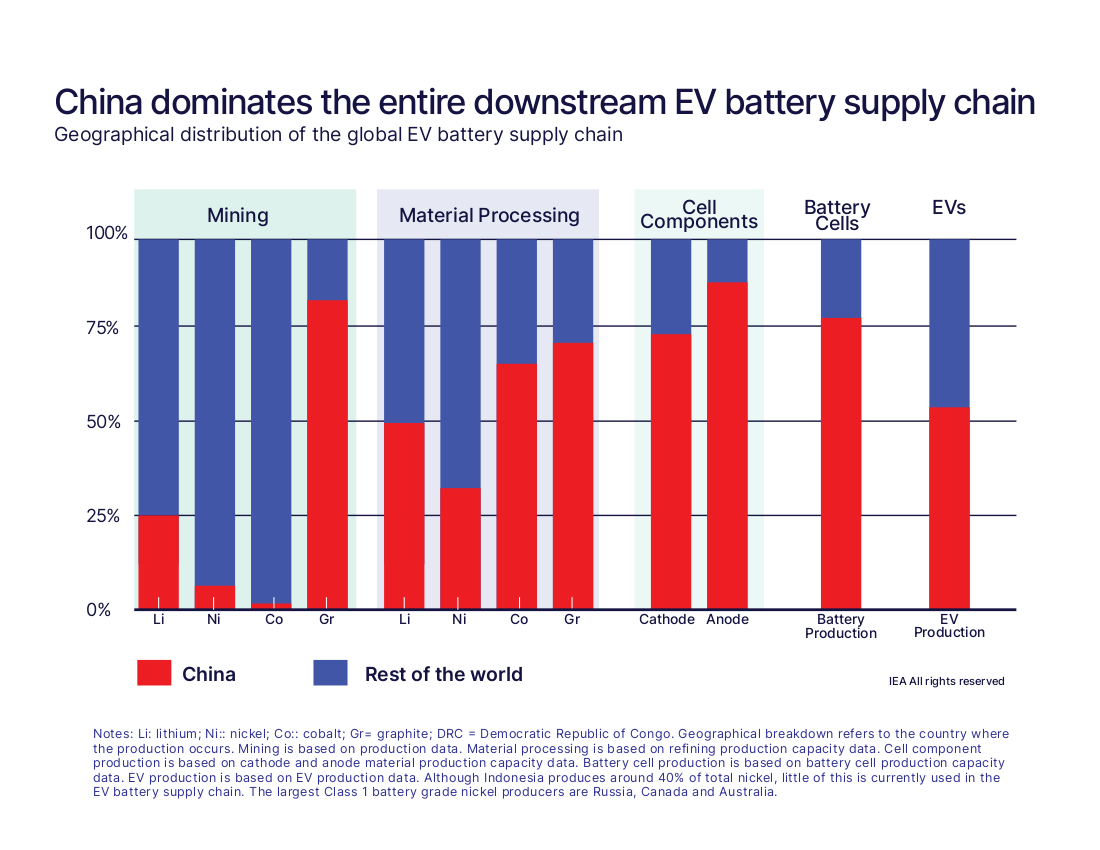

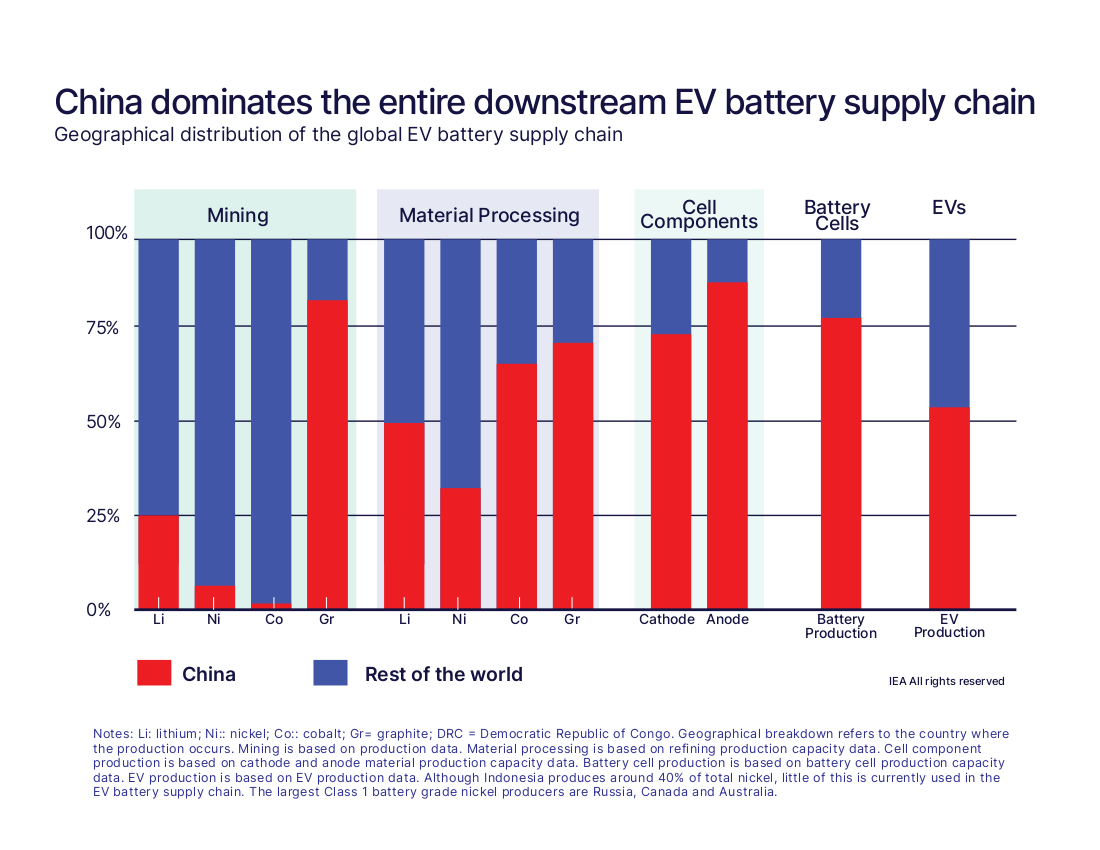

Concentration risk for Li-ion batteries becomes even more pronounced further downstream in the supply chain. A new report by the International Energy Agency (IEA) notes that China:

- Owns more than half of the world’s processing and refining capacity for lithium, cobalt and graphite.

- Controls 70% of global production capacity for cathodes and 85% for anodes – the two key battery components.

- Manufactures three-quarters of the world’s supply of Li-ion batteries, and accounts for 70% of new production capacity set to be added through 2030.

An Interos survey of 750 procurement executives in Q1 found that 85% were concerned that their supply bases were too concentrated in certain geographic regions, such as China.

A similar share of participants in the aerospace & defense (A&D) and IT & technology sectors – both also significant users of Li-ion batteries – took the same view.

Chinese producers are heavily embedded in key industry supply chains

An analysis of Interos’ global relationship platform data reveals that:

- Almost 300 A&D entities in the U.S., Europe and Japan have the leading Chinese lithium firms Ganfeng Lithium Co., Tianqi Lithium Corporation and Zijin Mining Group in their supply chains.

- China’s primary cobalt miner – and the world’s second largest after Glencore – China Molybdenum indirectly supplies a slew of leading automotive components, car manufacturing and A&D firms operating in Japan and China.

- Almost 167,000 U.S., European and Japanese firms have indirect (tier-2 or tier-3) relationships with Chinese cathode and anode components firms, notably Ningbo Shanshan, BTR New Materials Group Co., Shenzhen Capchem Technology Co. and Tianjin B&M Science and Technology Co.

- Almost 500 technology and automotive manufacturers in the U.S., Europe and Japan use the top three Chinese Li-ion battery makers, Contemporary Amperex Technology Co. (CATL), BYD and China Aviation Lithium Battery Co. (CALB).

- South Korean battery makers LG Energy Solution, Samsung SDI and SK Innovation are rated as “low risk” (average i-Score of 79), whereas Chinese battery makers BYD and CALB are rated “medium risk” (average i-Score of 63).

Alternative strategies deployed by governments and OEMs

The dependence on Chinese refining, component and battery manufacturers is of concern not only to companies, but also to many Western and Asian governments.

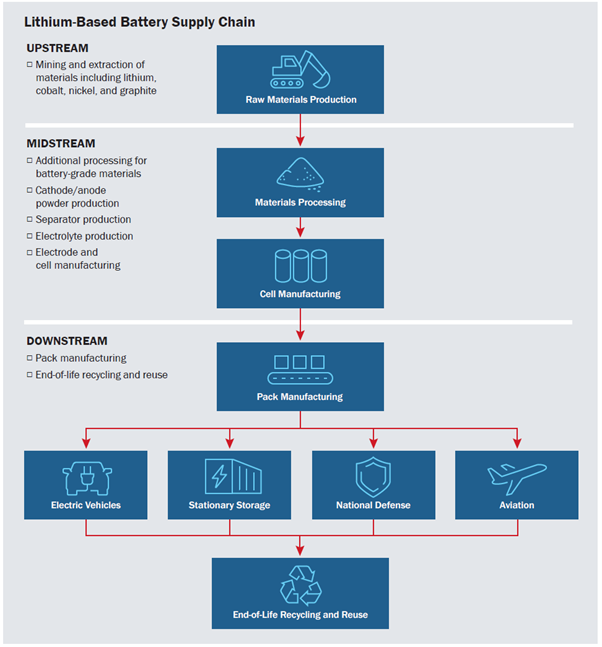

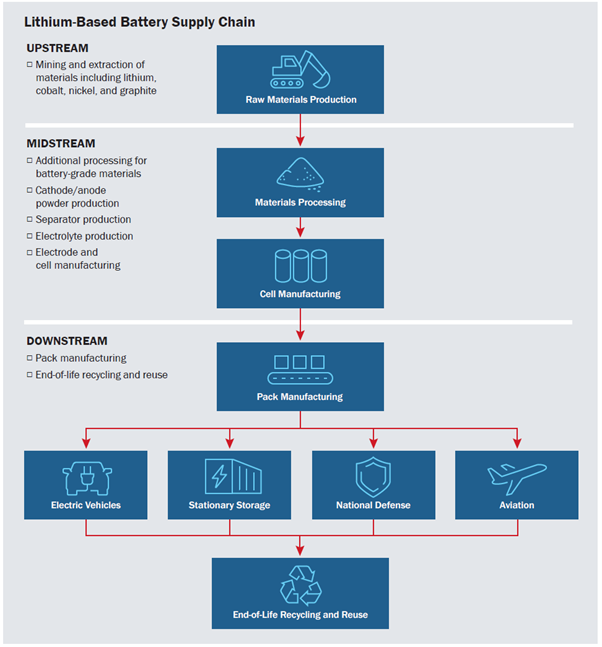

Last year the U.S. Department of Energy published a blueprint for lithium-based batteries. In the context of a market that is expected to grow 5-10 times in size by 2030, it calls for the development of a domestic supply chain to support EVs, electrical grid storage, aviation and national defense.

The plan includes more secure access to raw materials; the elimination of cobalt and nickel from battery formulas; and the expansion of onshore processing, cell production, pack manufacturing and recycling capacity.

Source: National Blueprint for Lithium Batteries, 2021-2030, Federal Consortium for Advanced Batteries

The European Commission unveiled a similar strategy back in 2018, while in Japan the Battery Association for Supply Chain was established last year, with 55 member firms spanning all industry segments, to develop policy recommendations.

Auto makers aren’t waiting around for national governments to reshape battery supply chains. Many are now pursuing their own strategies in an effort to head off future supply chain disruptions. The two main ones are:

- Direct sourcing from mining companies. During the past 12 months, Tesla has signed contracts with lithium, nickel and graphite miners, including BHP and Vale, as it ramps up its battery raw material purchasing. BMW and General Motors have each made multi-million dollar investments in lithium mining projects, while Ford, VW, Renault and Stellantis have all done their own lithium supply deals. GM has also signed a multi-year agreement for cobalt with Glencore.

- Diversification of battery manufacturing.S., European and Japanese OEMs are also extending their cell components and battery pack production capacity outside China. Suppliers Panasonic, LG Energy Solution and Samsung SDI have announced new battery manufacturing plants on the U.S. east coast. Redwood Materials, an electronics recycling specialist, is building a new cathode material plant in Nevada, close to Tesla’s Gigafactory. And Europe’s Northvolt is planning new factories in Germany and Sweden.

Changing battery chemistries is another strategy being pursued by auto makers such as VW and Tesla to improve range, lower costs and reduce dependence on raw materials such as cobalt. But, as with the development of new manufacturing plants, this will take several years to fully implement.

In the meantime, vertical integration – a characteristic of the early automotive pioneers, but out of fashion in recent decades – seems to be the order of the day, as the industry seeks to minimize its vulnerabilities and regain control of electronics supply chains.