By Klaudia Kokoszka & Mackenzie Clark

Coverage of the Wagner Group’s recent attempted mutiny in Russia naturally focused on the threat it posed to President Vladimir Putin’s power. Less well known is the role played by Yevgeny Prigozhin’s mercenary organization in the global supply chain for gold.

Wagner has long been suspected of operating in parts of Sub-Saharan Africa. In that region, they have exploited vulnerabilities in the gold supply chain to enrich themselves and fund their operations. Recent attention on the group has spurred a U.S. Africa Gold Advisory targeting a major source of their funding.

Using the Interos platform we identified over 600,000 companies that rely on conflict minerals. This broad exposure highlights the degree to which the global economy depends on a raw materials trade that directly benefits paramilitary and terrorist groups. These associations also pose significant regulatory and reputational concerns for companies that rely on these supply chains.

A History of Exploitation

On June 27, the U.S. Departments of State, the Treasury, Commerce, Homeland Security, Labor, and the United States Agency for International Development (USAID) warned firms to be on high alert to potential exposure to illicit gold within their supply chains.

This advisory followed a U.S. Treasury Office of Foreign Assets Control (OFAC) decision earlier in the year to sanction companies engaging with the Wagner Group in the illicit gold trade. The group uses this trade to fund its expansion. The proceeds also, like the Russian government, pay for Wagner’s military activities in Ukraine.

Wagner has also been connected to numerous human rights violations in the plunder of natural resources from conflict-affected nations. The group has long been known to have a presence across Sub-Saharan Africa. They are often found in the Central African Republic (CAR). The CAR is designated as a “country of concern” under the conflict minerals provision (Section 1502) of the Dodd Frank Act.

Since 2010, the Act has established an SEC (Securities and Exchange Commission) disclosure requirement for companies that manufacture products using so-called “conflict minerals”. The conflict minerals list consists of tin, tungsten, tantalum, and gold, and often referred to as “3TG”. These minerals originate from the Democratic Republic of the Congo and surrounding countries. These include Angola, Burundi, the CAR, Republic of the Congo, Rwanda, South Sudan, Tanzania, Uganda and Zambia.

These countries are at higher risk of exploitation by armed groups such as Wagner and Islamic State. These illicit entities finance their activities by taking advantage of vulnerabilities in the mining, processing, and distribution of conflict minerals. In the process, they are able to significantly enrich themselves.

Interos Supply Chain Data Analysis

We took a look at Interos’ global relationship platform data in conjunction with the National Resource Governance Institute’s Resource Contracts database. With this data, we mapped the extended supply chains of companies that hold 3TG mining contracts with countries of concern in Sub-Saharan Africa.

We identified over 600,000 companies that rely on conflict minerals either directly or indirectly, in the extended supply chain of the firms that hold these contracts. This includes 56 direct relationships to mining companies. It also includes 25,000 indirect buyer-supplier relationships in the second tier, and over five million relationships in the third tier.

These relationship networks quickly expand as you move away from the source of these minerals, which are generally several tiers deep within global supply chains.

Who Uses Conflict Minerals?

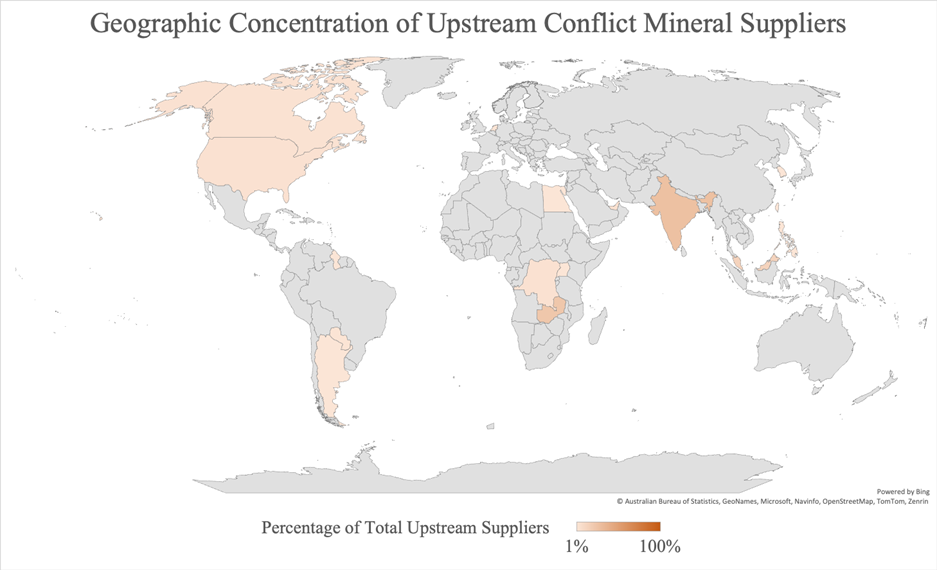

While the mining and processing of 3TG is based largely in the global south, the consumption of value-added goods containing these minerals, such as semiconductors, chips, wires, and batteries, is highly concentrated among Western Economies.

Of those firms that have direct relationships with the mining companies, more than three quarters are located in developing and growing economies. Over half are based in India.

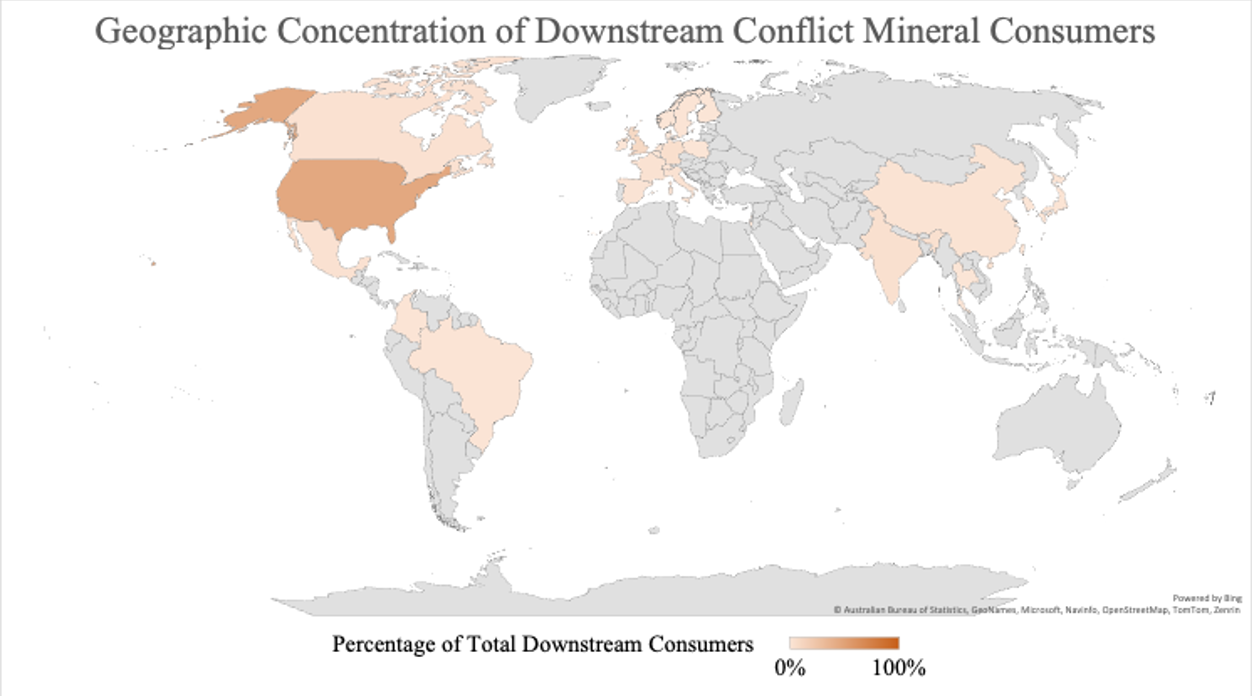

Downstream consumers of conflict minerals are defined as those likely purchasing a post-processed and value-added product. More than three quarters of these are based in North America and Europe.

The United States is the single largest 3TG purchaser, representing nearly 45% of all downstream consumers. The second largest is the United Kingdom, representing over 9% of downstream consumers.

Based on these findings, the United States holds an extremely sensitive position in the supply chains of 3TG, and disruptions to and regulatory risks associated with these commodities will strongly impact U.S. firms.

A broad range of industries rely on conflict minerals, either directly or indirectly. Some of the most exposed industries, based on prevalence among downstream consumers, include software and communications (8%), construction (4%), vehicle manufacturing (3%), information services (3%), medical products (3%), household electronics (3%) and aerospace engineering (1%).

These industries alone make up over 40% of the companies vulnerable to a disruption in the conflict mineral supply chain. They include some of the largest global producers of technology, software, transportation, and heavy machinery. The adverse impact to these types of companies derives from their reliance on raw minerals in the parts and components of the finished goods they purchase and produce.

Though many of these firms are not directly purchasing from the companies responsible for mining conflict minerals, illicit behavior in their extended supply chain could still adversely impact their reputation, regulatory compliance, and ultimately their ability to predictably produce the finished goods they sell.

How Can Organizations Get Proactive About Conflict Minerals?

Recent events have highlighted the importance of increased due diligence for firms that rely on gold and other raw minerals sourced from conflict-affected regions. Companies looking to safeguard their extended supply chains should consider integrating the following recommendations into their procurement processes:

- Increase and improve supply chain due diligence efforts related to the mining of conflict minerals, especially related to upstream business relationships and raw mineral suppliers.

- Understand potential reputational risks to your firm associated with purchasing 3TG products from conflict-affected countries. This includes human rights violations, forced labor and environmental degradation among other concerns.

- Understand potential compliance risks associated with purchasing 3TG products from conflict-affected countries. Pay attention to sanctions violations, money laundering and smuggling, among other concerns.

Regulation and Supply Chain Furor Over Minerals to Increase

Last month’s attempted mutiny highlighted the tangled interdependencies of geopolitics, raw materials, and supply chains. The U.S. Africa Gold Advisory is the latest policy action in a growing tide of regulations and concerns over conflict minerals. This swell of regulatory activity is likely to continue, and a similar increase is expected regarding critical minerals (which include aluminum, lithium, and nickel). These concerns have been compounded by recent actions by China in restricting the exports of metals critical to semiconductor production.