By Joshua Clarke and Trevor Howe, Senior Operational Resilience Consultants

Multiple supply chain risks converged this week, with Hurricane Idalia spreading chaos in the Southeastern U.S. and a coup – over 6000 miles across the Atlantic – in Gabon threatening further disruption – particularly for the aerospace & defense sector.

Gabon’s military seized power yesterday following a controversial presidential election. Supply chain leaders are tracking the fallout as the country is the world’s second-largest producer of an essential material, manganese ore. The coup heralds both an uncertain time for industrial and commercial activity in the country and potential disruptions to global supply chains.

The Criticality of Manganese

Manganese is crucial for several industries including aerospace and defense, energy production and storage, and automotive – among others – because of its use as an alloying agent, metal coating additive, and as a cheaper, more ethically sourced alternative to cobalt. The shutoff of Manganese imports could impact everything from batteries to guns to automotive transmissions. Interos’ analysis identified over 155,000 US companies likely to be impacted.

According to the U.S. Geological Survey (USGS): “Because manganese is essential and irreplaceable in steelmaking and its global mining industry is dominated by just a few nations, it is considered one of the most critical mineral commodities for the United States.”

Between 2018 and 2021, 67% of manganese ore imported to the U.S. was from Gabon, compared with 19% from South Africa and 12% from Mexico. The U.S. is 100% reliant upon imports of manganese ore for apparent consumption.

Second African Coup in a Month Threatens Regional Stability and Vital Exports

This past Wednesday, Gabonese soldiers announced on national television they seized power in the African nation of Gabon and arrested recently re-elected President Ali Bongo, whose family has held power in Gabon since 1967. The soldiers behind the coup announced that they have canceled the recently certified election results.

The military announced that the country’s borders would be temporarily closed. This resulted in the anchoring of 30 commercial vessels off the coast of Gabon while they awaited the resumption of activity at the Port of Libreville.

Gabon’s top export is crude petroleum, accounting for 60.7% of its exports at approximately 200,000 barrels per day, making it Africa’s seventh largest oil producer. But there is more concern around manganese ore, which is Gabon’s other primary export.

The ore accounts for almost 23% of the country’s export activity, valued at $1.34 billion annually. The French mining firm Eramet, reportedly the top producer of manganese worldwide (having produced 7.5 mega tonnes of ore in 2022), announced shortly after the coup that it would temporarily halt all operations in the country, including the transportation of already-extracted ore.

A Flexible Transition Metal

Manganese ore is a key component in steel and alloy production because of its structure as a transition metal, which allows it to improve the strength, workability and wear resistance of partner metals. Manganese consumption in the U.S. is overwhelmingly focused on the production of iron and steel products, with 90% of manganese ore directed to this use. Beyond these applications, manganese is utilized for:

- Aluminum alloys – Manganese, alloyed with copper, silicon, tin, nickel and zinc, is used to create high-strength and lightweight structures in aerospace and defense applications.

- Stainless steel – Manganese, alloyed with silicon and nitrogen, is used to create oxidization-resistant steel.

- Batteries – Manganese oxide, usually a processed version of manganese, is utilized in dry-cell and alkaline batteries to prevent the formation of hydrogen in a battery, preventing possible combustion or explosion.

- Copper alloy – Manganin, an alloy of copper, manganese, and nickel, is utilized to create shunt resistors, with a low-temperature coefficient and resistance to sulfur, these resistors are useful for creating large currents.

- Potassium permanganate – Manganese is essential to the production of potassium permanganate, which is widely used in drinking water and wastewater treatment.

- Manganese phosphate – This type of metal finishing is mostly used within engines, transmission systems and gears to provide smoother overall operation while increasing the service life of treated components.

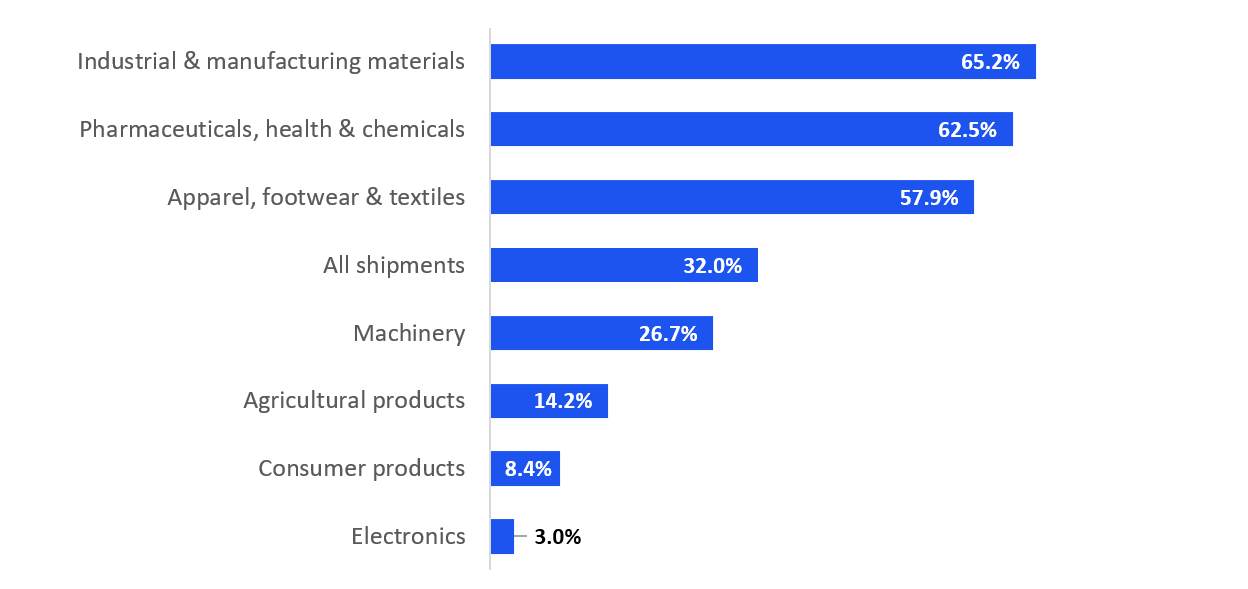

While the U.S. does maintain a domestic stockpile, disruption to manganese ore exports from Gabon could pose a material risk to American manganese refineries and manufacturers dependent on raw and refined manganese products. Manganese supply disruptions would most affect the following industries:

- Aerospace & defense – Safes, gun barrels and military helmets use steels with very high levels of manganese (up to 15%).

- Automotive manufacturing – Manganese is utilized as a safer, cheaper, and more ethical alternative to cobalt for use in electric vehicles.

- Manufacturing – In addition to iron and steel, manganese is used also as an alloy with metals such as aluminum and copper.

- Energy production and utilities – Manganese is widely regarded as one of the critical minerals for green transition technologies in the energy sector. It is essential for zinc-ion batteries, hydrogen fuel cells, and increased solar panel efficiency.

According to the USGS, manganese ore is consumed mainly by five companies at six U.S. facilities with plants principally in the Eastern and Midwestern States. Analysis by Interos suggests that these firms directly supply more than 200 U.S.-based customers and indirectly almost 155,000 as tier-2 suppliers.

Action That Affected Companies Need to Take

Since the coup, many countries in the international community have called for a return to Gabon’s elected government and to stability. Russia and China called for a peaceful resolution to the conflict, while France condemned the coup and called for a “commitment to free and transparent elections”.

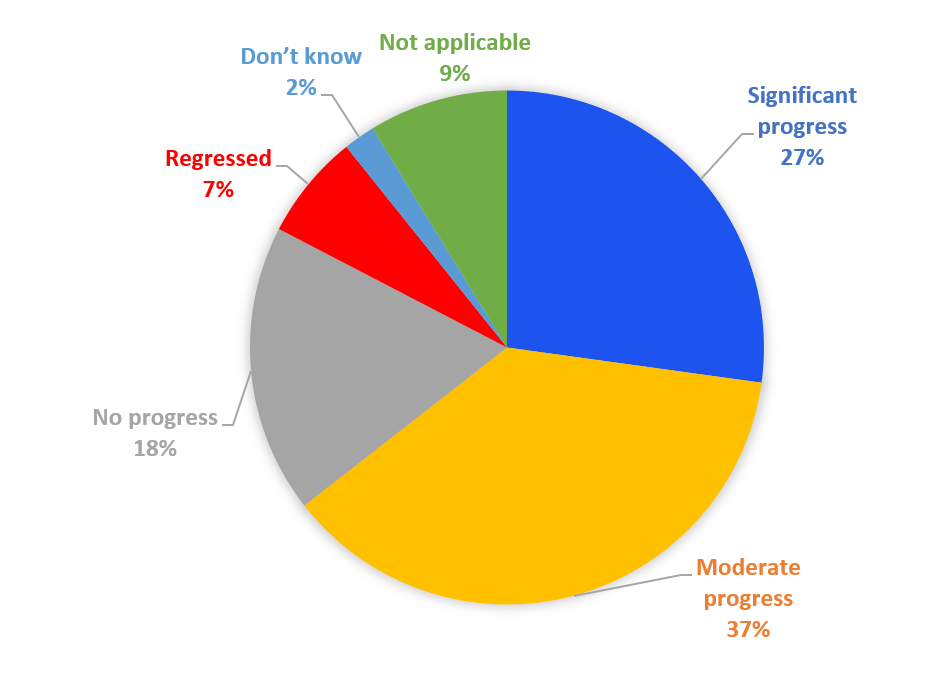

Regardless of the coup’s ultimate outcome, the situation in Gabon – and the impact uncovered by Interos, is a stark reminder of how geopolitical turmoil (and a high degree of reliance on single/highly concentrated sources) can intersect with natural disruptions, like Hurricane Idalia, to threaten supply chains a world away.

At this time of uncertainty, companies can ill afford to sit idly by. Those that are dependent on manganese ore, particularly aerospace & defense organizations, need to identify where it is sourced within their extended ecosystem and understand their level of dependence on Gabon and suppliers operating in the country.

With its artificial intelligence-based software, Interos is well positioned to support supply chain risk management programs for companies around the world trying to address this issue. Interos provides continuous monitoring of suppliers with timely alerts so that companies can both get ahead of potential supply chain disturbances and be among the first to react to them.