By: Alberto Coria, Klaudia Kokoszka and Trent Chinnaswamy

Since the onset of the COVID-19 pandemic, China has pursued a strict zero-COVID policy, employing draconian containment measures to limit transmission. This approach has limited fatalities but also severely impacted China’s economy, ensnarled global supply chains and —this past week — has fostered some of China’s most-visible protests and public dissent in years.

Several dozen protests across at least 22 cities may further imperil supply chain stability and, according to our analysis, could significantly affect companies reliant on Chinese electronics and metal wholesalers. The Chinese government’s as-yet-unknown response to the protests could prompt even greater disruption. Our analysis anticipates a simultaneous crackdown on protests and gradual loosening of some COVID restrictions — but nothing is certain.

Interos recommends reviewing your company’s footprint and potential concentration risk in the identified areas, to take early action and prevent any supply chain disruptions in your company’s ecosystem.

Protests in China and Supply Chain Disruption

It is worth noting that protests in China are rare – given the government’s massive surveillance apparatus and history of swift and brutal responses — which include censorship, imprisonment, and the “re-education through labor” of dissidents and activists. Many of the recent protests were sparked by the news of 10 deaths from an apartment fire in the city of Urumqi, Xinjiang Province — where emergency services were allegedly delayed from reaching the fire due to zero-COVID policies.

The protests have quickly spread across Xinjiang, with hundreds gathering in Beijing, Shanghai, Wuhan, Nanjing, and Zhengzhou. The largest confirmed protests against China’s zero-COVID policies so far have been under 1,000 people each, in major metropolitan areas.

Chinese security forces have so far tried to subdue protests through nonlethal force, with mixed success. It is assumed that many of the citizens protesting have been arrested, in addition to one confirmed report of a BBC journalist being beaten and detained. The government has so far struggled to immediately censor the online appearances of the protests, but all evidence of the unrest has been removed within an hour of posting.

Industry Impact of China’s Protests: Electronics and Metals Supply Chain in the Crosshairs

China’s current economic woes are difficult to overstate. Prior to the protests, profits at Chinese industrial companies had fallen 3% from January to October due to COVID lockdowns hindering activity.

The impact of the protests themselves has —so far —been much more limited. This is because the protests are occurring in areas where government lockdowns have already shuttered business.

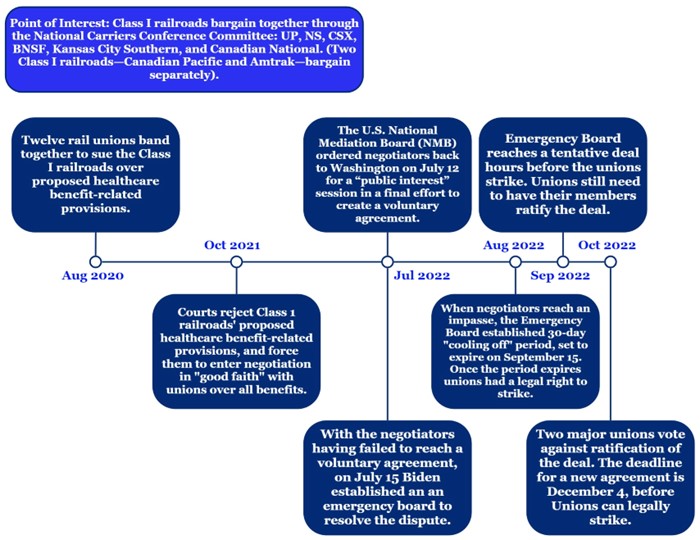

The most immediate supply chain disruption connected to the protests themselves have occurred at Foxconn’s now-notorious facility in Zhengzhou. Workers expressed their fury after pay was disrupted due to a COVID-19 lockdown. Foxconn claims the lockdown and subsequent unrest have caused the company to miss this year’s production targets which would primarily impact Apple, Inc.

The next major supply shift, and the impact on China’s national production, will depend entirely on the Chinese government’s response to the protests and how — if at all — the government’s zero-COVID policy changes.

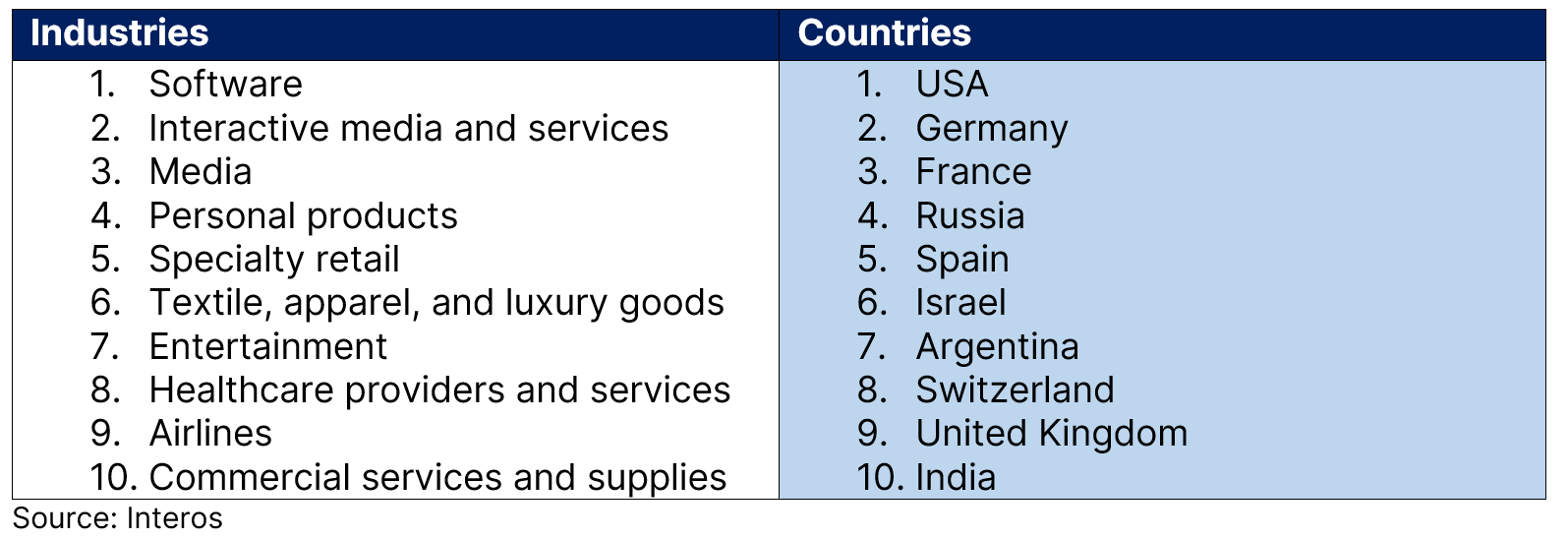

According to Interos analysis, electronics parts wholesalers are among the top 10 industries in all of the cities affected by protests. Metal wholesaling is also a prevalent industry in Nanjing, Shanghai, and Urumqi. Should further disruption occur due to the government’s response to the protests, we can expect that these industries would be affected disproportionately.

Beijing Likely to Increase Security and Online Censorship to Quell Protests

As the Chinese Government decides how to act, the country has reported its highest-ever COVID-19 infection rates. On November 23rd, the government announced that over 30,000 cases were detected, the highest single-day total for the country. This puts the Chinese government in a double-bind, as tightening COVID restrictions could spark more fury, but relaxing restrictions could let the virus loose on a country that is not prepared, medically or politically, for an upswing in cases.

Interos analysis concludes that based on the central government’s response to prior instances of dissent, such as the pro-democracy protests of Hong Kong in 2019 and the Beijing protests prior to the National Congress, it is likely for the central government to curtail the spread of protests through increased security measures, stronger shows of force, and online censorship.

However, a crackdown on protests coupled with tightening COVID restrictions could create additional pressure on Western businesses (many of whom are already under fire for connections to the Chinese government’s various human rights abuses) to relocate to more-favorable areas such as India.

What’s Next for the Supply Chain? Certain zero-COVID Policies Loosened at Provincial Level, While Others Tightened

Below are three likely potential scenarios:

- The central government begins a more widespread loosening of zero-COVID policies, similar to their approach in Guangdong.

- Zero-COVID policies continue to be implemented in areas of high transmission, following the policies that Xi Jinping has indicated in recent national addresses.

- Zero-COVID restrictions are broadly increased as the central government attempts to double down on its efforts, and uses the restrictions as a way to further limit

Interos analysis finds it most-likely that amidst government crackdowns on protests, certain zero-COVID policies will be loosened at the provincial level to ease international business, while others will be tightened in favor of increased security and political suppression.

This approach allows the central government to continue its zero-COVID policy, while beginning to address some of the economic challenges that it has put on the country. The central government directly linked the initiative to a desire to protect its suffering semiconductor sector, and bolster its technological development as a whole.

Some provinces in China have already been able to slightly loosen their respective COVID restrictions, with the central government hoping to reduce disruption to the transport of goods, industrial activity, and international investment. In Guangdong province, local officials received direction from the central government in early November that they would no longer have to track secondary close contacts of confirmed COVID cases. Additionally, the local officials were directed to ease the ability of foreign business executives to travel into the region.

Similarly, following the recent protests in the Xinjiang cities of Urumqi and Korla, the two cities announced that they would begin to ease certain zero-COVID restrictions and reopen businesses and restart public transportation.

However, nothing is certain. According to some estimates, an unrestrained outbreak of the Omicron variant could kill as many as 1.5 million people in the 80+ age group alone. With China’s rising case numbers, limited hospital beds, low vaccination rates (and less-effective vaccines), and Xi Jinping’s recent consolidation of power the government may opt to maintain or even increase restrictions.

Given the precariousness of the situation, the case for active, continuous, and multi-tier supply chain monitoring has never been clearer.

Recommended Actions for Improving Supply Chain Resilience

Interos recommends taking the following actions to promote supply chain resilience:

- Communicate frequently with key Chinese suppliers (or suppliers you know to be reliant on China) to determine the production impacts of government restrictions on COVID and protests.

- Ascertain whether suppliers in China are preparing for an increased governmental security posture.

- Identify which 4th and 5th party Chinese suppliers are critical to your direct suppliers.

- Prepare for a potential disruption in goods shipping out of Chinese ports due to zero-covid measures by identifying alternative suppliers or adjusting expectations accordingly for delays.

- Ensure compliance with the Uyghur Forced Labor Prevention Act (UFLPA), as protests against the zero-COVID policy are one of many risks emerging from the Xinjiang region

Organizations looking to understand where the next big supply chain shock is coming from – and which suppliers they need to engage with to mitigate the impact – should consider investing in supply chain visibility and operational resilience solutions. In times of turmoil, knowing who you are connected to, and how those parties will be impacted by unfolding events, can make the difference between continuity of operations and disaster. It’s no wonder then, that most organizations plan to implement supply chain visibility solutions by Q2 2023 — a fact we learned from our annual supply chain industry survey.