Navigating the Chaos: A CEO’s Reflection on Supply Chain Resilience in 2023

2023 has been a year of equal parts disruption and opportunity for supply chains. Disasters, war, regulations, and cyber-attacks kept supply chains off balance and at-risk, even as powerful new technologies and digital transformations point to a more resilient 2024.

In my candid discussions with public and private sector industry leaders spanning Aerospace & Defense, Financial Services, Energy, Healthcare and others, a common set of challenges echoed across boardrooms and legislative committees: Which AI-driven solutions can effectively stay a step ahead of risks? How do we foster collaboration with suppliers and third parties that go beyond mere management to proactive threat mitigation? And where should we strategically invest to not only comply with new regulations but also enhance resilience and boost profitability?

Regardless of the answers, the reignition of multiple global conflicts and an explosion of new capabilities to combat the ensuing disruption – alongside a surge in supply chain policymaking – fueled five important supply chains trends in 2023:

1. AI Takes Center Stage: “Generative AI has the potential to change the world in ways that we can’t even imagine.” ― Bill Gates

AI capabilities and interest exploded this year – marking the entry into a new AI-centric era for the business world and supply chains. 40% of businesses already plan to increase their investment in generative AI alone.

Customers are unequivocal that technologies like Big Data and AI are not just seen as operational tools or novelties – they’re pivotal in transforming procurement and risk management from sporadic and reactive to continuous and proactive, from “just-in-time” to “all-the-time”, and ultimately, from cost centers to sources of strategic advantage.

AI is enabling cutting-edge supply chain risk capabilities, including scenario modelling and event forecasting, allowing organizations to more easily build supply chain digital twins, and simulate the effects of multiple disruptions and mitigation efforts and the impacts of adding and removing specific suppliers.

But AI isn’t a panacea – and every new technology has a dark side. Adversarial AI, AI-botnets, and Language Learning Model (LLM)-powered phishing attacks (to name a few emerging threats) all help make the case that taking a multi-tier, supply chain wide-view of cybersecurity and software Bills of Materials have never been more important.

2. Global Disruptions and Catastrophes Set Records: “We don’t have any magic bullets in navigating the supply chain.” ― Jensen Huang, CEO, NVIDIA

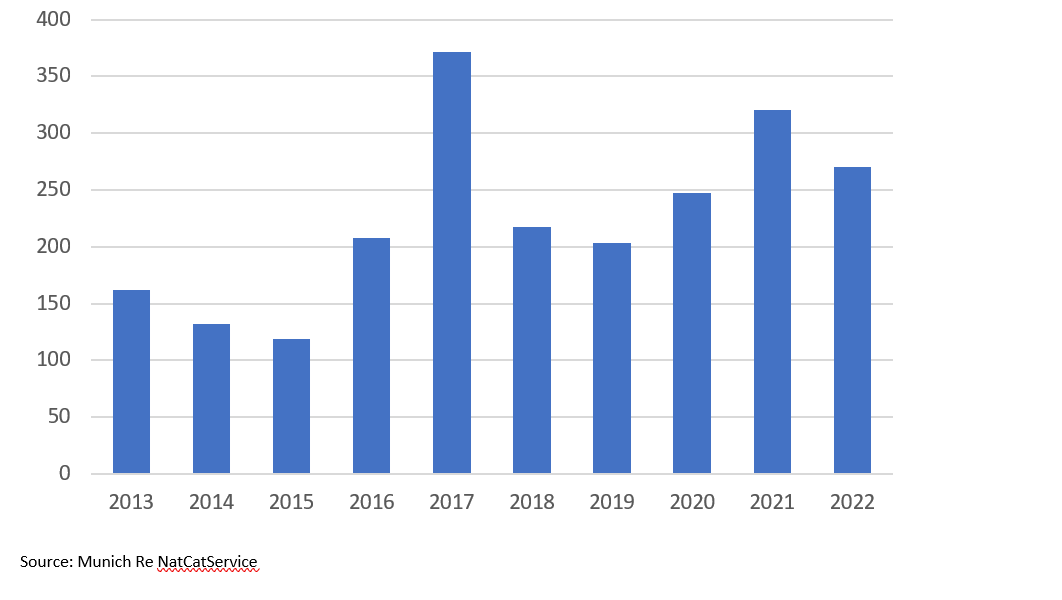

2023 was a year of “catastrophic” disruption. While COVID shockwaves eased, new disruptions arose. Hurricane Idalia swept through Florida, one of the largest wildfires in history occurred in Greece, and flash floods ravaged Italy. Per NOAA, 2023 has been the worst year for billion-dollar natural disasters in history, with 23 such events occurring in the first eight months of the year alone – resulting in $57.6 billion in total losses.

The deluge of natural disasters and catastrophic risk played a significant role in Interos’ decision to release our own updated catastrophic risk model which proactively and continuously visualizes multi-tier suppliers impacted by a range of hazards, including weather patterns, climate, communication, infrastructure, and healthcare capacity.

When I talk to our customers with large-scale, multi-year programs – these enterprises share that they need the ability to project where things are going with respect to weather, inflation, energy crisis and other trends to make better-informed business decisions based on the impact to their supply chain’s ongoing operations.

3. Supplier Collaboration Becomes Essential: “Our goal is to work hand-in-hand with suppliers to help them improve their management systems, rather than to simply remove them from our supply chain without correcting the issues we discovered.” – Apple, Supplier Code of Conduct

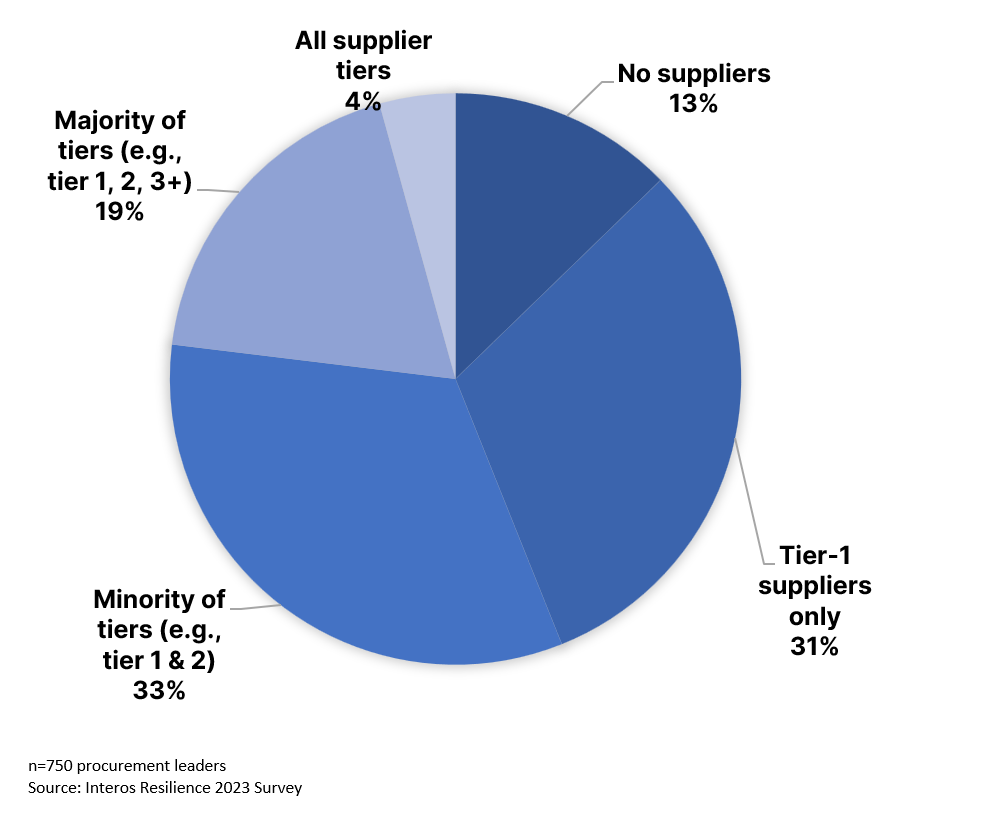

Supplier collaboration has emerged as a key strategy in navigating these disruptions. Across manufacturers, banks, the Department of Defense and others, it’s clear all these enterprises are starting to recognize that close, mutually collaborative relationships with key suppliers helps.

Closer relationships between buyers and suppliers – as well as players within the same industry – can lead to the development of innovative new products, integrated approaches to supply-chain risk management, and improvements in forecasting, planning, and capacity management. This collaboration enhances service levels, mitigates risks, and strengthens the combined supply chain.

Take Unilever’s partnership with Novozyme to develop sustainable detergents, which leverages each party’s strengths to create enzyme innovations that improved product performance and market penetration while also reducing energy consumption and CO2 emissions.

4. Shifting Geopolitical and Digital Forces Spur Deglobalization: “We are entering from my perspective the next phase of globalization,” Christian Klein, CEO, SAP

2023 saw continued fighting in Russia and Ukraine, war in Gaza, a presidential crisis in Venezuela, and a coup in Niger – and these are just a few examples of the geopolitical conflicts buffeting supply chains in 2023.

Geopolitical tensions and policy changes are contributing to the deglobalization of supply chains. Nations are beginning to move towards self-sufficiency and establishing ‘friend shoring’ relationships to secure supply chains against international instabilities.

Many companies are relocating production closer to their primary markets. Mattel, Unilever, and numerous automakers have all announced expanding their presence in Mexico – instead of their traditional manufacturing regions such as Vietnam, China, and Malaysia. Apple is seeking to manufacture one-quarter of its iPhones in India, shifting production away from China amid US-China tensions.

Digital conflict remains a pivotal battlefield for enterprises. Cyberattacks are expected to hit a total of $11.5 trillion in economic damages by the end of this year. According to Mandiant, the leading threat intelligence company, supply chain attacks through software are up 700% year-over-year and Interos’ research found that 78% of procurement and information security leaders believe their teams need to share information and partner more effectively to help stem these and other software threats.

5. Lawmakers Double Down on Resilience: “After years of delay in parts and products, everyone knows why supply chains are so important.” – U.S. President Joe Biden

In the US, lawmakers passed the CHIPS & Science act, the Bipartisan Infrastructure Law, and the Inflation Reduction Act. All focused on addressing key supply chain vulnerabilities, driving significant private sector investment in industries like semiconductors, electric vehicles, and batteries. Congress also passed the Uyghur Forced Labor Prevention Act – essentially barring most imports from Xinjiang – and President Biden convened the first ever White House Council on Supply Chain Resilience.

Across the Atlantic, the EU has also implemented a broad array of supply chain-centric legislation. For example, the EU’s new Carbon Border Adjustment Mechanism sets a new standard for ESG supply chain scrutiny – which requires companies to disclose the full carbon footprint of any imported goods – and buy emissions offset certificates for any emissions in excess of the EU’s standards. And even more fast moving is the Digital Operational Resilience Act (DORA), a new European framework that focuses on embedding a more robust and resilient approach to delivering digital capabilities in financial markets. By 2025, the framework shifts the focus from guaranteeing firms’ financial soundness to also ensuring they can maintain resilient operations through severe operational disruption caused by cyber security and information and communication technology (ICT) issues.

The financial sector in particular saw changes in expectations around third- and fourth-party risk – spurred by high profile financial failures like Silicon Valley Bank, which briefly upended a significant portion of the technology sector this year. The global finical market set a new standard for scrutiny within the sector and across the globe.

New regulations include the U.S.’ final Interagency Guidelines for Third Party Risk Management, to Canada’s B-10, APRA CPS 234: Best Practices for Meeting Third-Party Risk Management Requirements, the UK’s Financial Conduct Authority (FCA): FG16/5: Guidance for firms outsourcing to the ‘cloud’ and other third party IT services (PRA Compliant), to European Banking Authority (EBA): EBA Guidelines on ICT and security risk management; and the EBA Guidelines on outsourcing arrangements. And lawmakers have made it clear: more is to come.

What’s Next

As I reflect on 2023, first, I want to say a heartfelt “Thank You” to our customers – this has been a journey, and we could not have done anything without the partnership we have with each one of you.

Next, what stays with me is the duality of risks and opportunities that define operational resilience. New capabilities, driven by a generational explosion in AI investment and enthusiasm, are changing the way businesses look at their supply chains – just as emerging and systemic threats have reshaped them.

Most of all, I see how enterprise has firmly shifted away from a laser focus on operational efficiency, to a more complex and nuanced agenda – where balanced risk management is a strategic imperative, markets mandate continuous visibility, and the next best action is a competitive advantage. As we look ahead, continued collaboration and innovation are certain to usher in more opportunities for growth in 2024.